SUP 1

The FSA's

approach to supervision

SUP 1.1

Application and purpose

- 01/12/2004

Application

SUP 1.1.1

See Notes

- 21/06/2001

Purpose

SUP 1.1.2

See Notes

- 21/06/2001

- Future version of SUP 1.1.2 after 01/11/2007

SUP 1.1.3

See Notes

- 21/06/2001

- Future version of SUP 1.1.3 after 06/08/2010

SUP 1.1.4

See Notes

- 21/06/2001

SUP 1.2

Introduction

- 01/12/2004

SUP 1.2.1

See Notes

- 21/06/2001

- Future version of SUP 1.2.1 after 28/08/2007

SUP 1.2.2

See Notes

- 01/04/2004

- Future version of SUP 1.2.2 after 01/04/2009

SUP 1.2.3

See Notes

- 21/06/2001

SUP 1.3

The FSA's risk based approach to supervision

- 01/12/2004

Purpose

SUP 1.3.1

See Notes

- 21/06/2001

Impact and probability assessment

SUP 1.3.2

See Notes

- 21/06/2001

SUP 1.3.3

See Notes

- 21/06/2001

- Future version of SUP 1.3.3 after 06/08/2010

SUP 1.3.4

See Notes

- 21/06/2001

SUP 1.3.5

See Notes

- 21/06/2001

SUP 1.3.6

See Notes

- 21/06/2001

The scope of the risk assessment process for firms

SUP 1.3.7

See Notes

- 21/06/2001

SUP 1.3.8

See Notes

- 21/06/2001

SUP 1.3.9

See Notes

- 21/06/2001

SUP 1.3.10

See Notes

- 21/06/2001

The nature of the FSA's relationship with firms

SUP 1.3.11

See Notes

- 21/06/2001

SUP 1.3.12

See Notes

- 21/06/2001

SUP 1.4

Tools of supervision

- 01/12/2004

SUP 1.4.1

See Notes

- 21/06/2001

SUP 1.4.2

See Notes

- 21/06/2001

SUP 1.4.3

See Notes

- 21/06/2001

SUP 1.4.4

See Notes

- 21/06/2001

SUP 1.4.5

See Notes

- 21/06/2001

SUP 1.4.6

See Notes

- 21/06/2001

SUP 1.4.7

See Notes

- 21/06/2001

SUP 1.5

Lead supervision

- 01/12/2004

Application

SUP 1.5.1

See Notes

- 21/06/2001

Purpose

SUP 1.5.2

See Notes

- 21/06/2001

Process

SUP 1.5.3

See Notes

- 21/06/2001

SUP 1.5.4

See Notes

- 21/06/2001

SUP 2

Information gathering by the FSA on its own initiative

SUP 2.1

Application and purpose

- 01/12/2004

Application

SUP 2.1.1

See Notes

- 21/06/2001

- Future version of SUP 2.1.1 after 01/04/2013

SUP 2.1.2

See Notes

- 21/06/2001

Purpose

SUP 2.1.3

See Notes

- 21/06/2001

- Future version of SUP 2.1.3 after 06/08/2010

SUP 2.1.4

See Notes

- 01/04/2003

- Future version of SUP 2.1.4 after 28/08/2007

SUP 2.1.5

See Notes

- 21/06/2001

- Future version of SUP 2.1.5 after 28/08/2007

SUP 2.1.6

See Notes

- 21/06/2001

SUP 2.1.7

See Notes

- 21/06/2001

SUP 2.1.8

See Notes

- 21/06/2001

SUP 2.1.9

See Notes

- 21/06/2001

SUP 2.2

Information gathering by the FSA on its own initiative: background

- 01/12/2004

- Future version of SUP 2.2 after 01/04/2013

Link to the statutory information gathering and investigation powers

SUP 2.2.1

See Notes

- 21/06/2001

- Future version of SUP 2.2.1 after 01/04/2013

SUP 2.2.2

See Notes

- 21/06/2001

- Future version of SUP 2.2.2 after 01/04/2013

Banking confidentiality and legal privilege

SUP 2.2.3

See Notes

- 21/06/2001

Confidentiality of information

SUP 2.2.4

See Notes

- 21/06/2001

Admissibility of information in proceedings

SUP 2.2.5

See Notes

- 21/06/2001

SUP 2.3

Information gathering by the FSA on its own initiative: cooperation by firms

- 01/12/2004

- Future version of SUP 2.3 after 01/04/2013

Introduction: Methods of information gathering requiring cooperation

SUP 2.3.1

See Notes

- 21/06/2001

SUP 2.3.2

See Notes

- 21/06/2001

- Future version of SUP 2.3.2 after 01/04/2013

Access to a firm's documents and personnel

SUP 2.3.3

See Notes

- 21/06/2001

- Future version of SUP 2.3.3 after 01/04/2013

SUP 2.3.4

See Notes

- 21/06/2001

- Future version of SUP 2.3.4 after 01/04/2013

Access to premises

SUP 2.3.5

See Notes

- 21/06/2001

- Future version of SUP 2.3.5 after 01/11/2012

SUP 2.3.6

See Notes

- 21/06/2001

- Future version of SUP 2.3.6 after 01/04/2013

Suppliers under material outsourcing arrangements

SUP 2.3.7

See Notes

- 21/06/2001

- Future version of SUP 2.3.7 after 01/04/2013

SUP 2.3.8

See Notes

- 21/06/2001

- Future version of SUP 2.3.8 after 01/04/2013

SUP 2.3.9

See Notes

- 21/06/2001

- Future version of SUP 2.3.9 after 01/04/2013

SUP 2.3.10

See Notes

Information requested on behalf of other regulators

SUP 2.3.11

See Notes

SUP 2.3.12

See Notes

SUP 2.4

'Mystery shopping'

- 01/12/2004

SUP 2.4.1

See Notes

- 21/06/2001

- Future version of SUP 2.4.1 after 01/07/2011

SUP 2.4.2

See Notes

- 21/06/2001

SUP 2.4.3

See Notes

- 21/06/2001

SUP 2.4.4

See Notes

- 21/06/2001

SUP 3

Auditors

SUP 3.1

Application

- 01/12/2004

SUP 3.1.1

See Notes

- 21/06/2001

- Future version of SUP 3.1.1 after 01/04/2013

SUP 3.1.2

See Notes

Applicable sections (see SUP 3.1.1 R)

| (1) Category of firm | (2) Sections applicable to the firm | (3) Sections applicable to its auditor | |

| (1) | Authorised professional firm which is required by IPRU(INV) 2.1.2R to comply with chapters 3, 5,10 or 13 of IPRU(INV) (Note 1) | SUP 3.1 - SUP 3.7 | SUP 3.1, SUP 3.2, SUP 3.8 - SUP 3.10 |

| (2) | Authorised professional firm not within (1) to which either or both of CASS 2 (Client assets) and CASS 4 (Client money and mandates: designated investment business) applies , unless the firm is regulated by The Law Society (England and Wales), The Law Society of Scotland or The Law Society of Northern Ireland (Note 2) | SUP 3.1 - SUP 3.7 | SUP 3.1, SUP 3.2, SUP 3.8, SUP 3.10 |

| (3) | Authorised professional firm not within (1) or (2) which has an auditor appointed under or as a result of a statutory provision other than in the Act | SUP 3.1, SUP 3.2, SUP 3.7 | SUP 3.1, SUP 3.2, SUP 3.8 |

| (4) | Bank or building society which in either case carries on designated investment business (Note 2A) | SUP 3.1-SUP 3.7 | SUP 3.1, SUP 3.2, SUP 3.8, SUP 3.10 |

| (5) | Bank or building society which in either case does not carry on designated investment business (Note 2A) | SUP 3.1 - SUP 3.7 | SUP 3.1, SUP 3.2, SUP 3.8 |

| (5A) | Credit union | SUP 3.1 - SUP 3.7 | SUP 3.1, SUP 3.2, SUP 3.8 |

| (5B) | ELMI | SUP 3.1 - SUP 3.7 | SUP 3.1, SUP 3.2, SUP 3.8 |

| (6) | Insurer, the Society of Lloyd's, underwriting agent or members' adviser (Note 5) | SUP 3.1 - SUP 3.7 | SUP 3.1, SUP 3.2, SUP 3.8 |

| (7) | Investment management firm, personal investment firm (other than a small personal investment firm), UCITS management company, or securities and futures firm (Note 3) | SUP 3.1 - SUP 3.7 | SUP 3.1, SUP 3.2, SUP 3.8 - SUP 3.10 |

| (8) | Small personal investment firm or service company which, in either case, has an auditor appointed under or as a result of a statutory provision other than in the Act | SUP 3.1, SUP 3.2, SUP 3.7 | SUP 3.1, SUP 3.2, SUP 3.8 |

| (9) | Mortgage lender | SUP 3.1 - SUP 3.7 | SUP 3.1, SUP 3.2, SUP 3.8 |

| (10) | Insurance intermediary (other than an exempt insurance intermediary) to which CASS 5 (Client money and mandates) (except for CASS 5.2 (Holding money as agent)) applies (see Note 4) | SUP 3.1 - SUP 3.7 | SUP 3.1, SUP 3.2, SUP 3.8, SUP 3.10 |

| (11) | Exempt insurance intermediary and insurance intermediary not subject to SUP 3.1.2 R(10) which has an auditor appointed under or as a result of a statutory provision other than in the Act | SUP 3.1, SUP 3.2, SUP 3.7 | SUP 3.1, SUP 3.2, SUP 3.8 |

| (12) | Mortgage intermediary or mortgage administrator which has an auditor appointed under or as a result of a statutory provision other than in the Act. | SUP 3.1, SUP 3.2, SUP 3.7 | SUP 3.1, SUP 3.2, SUP 3.8 |

| Note 1 = This chapter applies to an authorised professional firm in row (1) (and its auditor) as if the firm were of the relevant type in the right-hand column of IPRU(INV) 2.1.4R. | |||

| Note 2 = In row (2): (a) CASS 2 (Client assets) is treated as applying only if (i) the firm safeguarding and administering investments in connection with managing investments (other than when acting as trustee) or (ii) it safeguarding and administering investments in relation to bonded investments; (b) CASS 4 (Client money and mandates: designated investment business) is treated as applying only if the firm receives or holds client money other than under an arrangement where commission is rebated to the client; but, if CASS 2 or CASS 4 is treated as applying, then SUP 3.10 (Duties of auditors: notification and report on client assets) applies to the whole of the business within the scope of CASS 2 or CASS 4. |

|||

| Note 2A = For this purpose, designated investment business does not include either or both: (a) dealing which falls within the exclusion in article 15 of the Regulated Activities Order (Absence of holding out etc) (or agreeing to do so); and (b) dealing in investments as principal (or agreeing to do so): (i) by a firm whose permission to deal in investments as principal is subject to a limitation to the effect that the firm, in carrying on this regulated activity, is limited to entering into transactions in a manner which, if the firm was an unauthorised person, would come within article 16 of the Regulated Activities Order (Dealing in contractually based investments); and (ii) in a manner which comes within that limitation; having regard to article 4(4) of the Regulated Activities Order (Specified activities: general: core investment services by investment firms). |

|||

| Note 3 = This note applies in relation to an oil market participant to which IPRU(INV) 3 does not apply and in relation to an energy market participant to which IPRU(INV) 3 does not apply. In SUP 3: (a) only SUP 3.1, SUP 3.2 and SUP 3.7 are applicable to such a firm; and (b) only SUP 3.1, SUP 3.2 and SUP 3.8 are applicable to its auditor; and, in each case, only if it has an auditor appointed under or as a result of a statutory provision other than in the Act. |

|||

| Note 4 = The client money audit requirement in SUP 3.1.2 R(10) therefore applies to all insurance intermediaries except: • those which do not hold client money or other client assets in relation to insurance mediation activities; or • those which only hold up to, but not exceeding, £30,000 of client money under a statutory trust arising under CASS 5.3. Insurance intermediaries which, in relation to insurance mediation activities, hold no more than that amount of client money only on a statutory trust are exempt insurance intermediaries. |

|||

| Note (5) = In row (6): | |||

| (a) | SUP 3.1 - SUP 3.7 applies to a managing agent in respect of its own business and in respect of the insurance business of each syndicate which it manages; and | ||

| (b) | SUP 3.1, SUP 3.2 and SUP 3.8 apply to the auditors of a managing agent and the auditors of the insurance business of each syndicate which the managing agent manages. | ||

SUP 3.1.2A

See Notes

Incoming firms

SUP 3.1.3

See Notes

- 21/06/2001

- Future version of SUP 3.1.3 after 01/11/2007

SUP 3.1.4

See Notes

- 21/06/2001

- Future version of SUP 3.1.4 after 01/04/2013

SUP 3.1.5

See Notes

- 21/06/2001

- Future version of SUP 3.1.5 after 01/04/2013

SUP 3.1.6

See Notes

- 21/06/2001

- Future version of SUP 3.1.6 after 31/12/2007

Auditors of lead regulated firms

SUP 3.1.7

See Notes

- 21/06/2001

- Future version of SUP 3.1.7 after 31/12/2007

Authorised professional firms

SUP 3.1.8

See Notes

- 21/06/2001

- Future version of SUP 3.1.8 after 01/11/2007

Material elsewhere in the Handbook

SUP 3.1.9

See Notes

SUP 3.1.10

See Notes

Other relevant sections of the Handbook (see SUP 3.1.9 G)

Enabling provision and application

SUP 3.1.11

See Notes

Purpose

SUP 3.1.12

See Notes

Insurance market direction on rules concerning auditors and actuaries

SUP 3.1.13

See Notes

SUP 3.1.14

See Notes

SUP 3.1.15

See Notes

SUP 3.1.16

See Notes

SUP 3.1.17

See Notes

SUP 3.1.18

See Notes

SUP 3.2

Purpose

- 01/12/2004

Purpose: general

SUP 3.2.1

See Notes

- 21/06/2001

- Future version of SUP 3.2.1 after 01/04/2013

SUP 3.2.2

See Notes

- 21/06/2001

- Future version of SUP 3.2.2 after 06/10/2007

SUP 3.2.3

See Notes

- 21/06/2001

Limited application for certain types of firm and their auditors

SUP 3.2.4

See Notes

- 20/09/2001

Insurance intermediaries and their auditors

SUP 3.2.5

See Notes

- 01/04/2005

- Future version of SUP 3.2.5 after 06/10/2006

SUP 3.2.6

See Notes

- 01/04/2005

SUP 3.3

Appointment of auditors

- 01/12/2004

Purpose

SUP 3.3.1

See Notes

- 21/06/2001

- Future version of SUP 3.3.1 after 01/04/2013

Appointment by firms

SUP 3.3.2

See Notes

- 01/11/2004

- Future version of SUP 3.3.2 after 01/07/2012

SUP 3.3.3

See Notes

- 21/06/2001

- Future version of SUP 3.3.3 after 06/06/2008

Appointment by the FSA

SUP 3.3.7

See Notes

- 21/06/2001

- Future version of SUP 3.3.7 after 01/04/2013

SUP 3.3.8

See Notes

- 21/06/2001

- Future version of SUP 3.3.8 after 01/04/2013

SUP 3.3.9

See Notes

- 21/06/2001

- Future version of SUP 3.3.9 after 01/04/2013

SUP 3.3.10

See Notes

SUP 3.4

Auditors' qualifications

- 01/12/2004

Purpose

SUP 3.4.1

See Notes

- 21/06/2001

- Future version of SUP 3.4.1 after 01/04/2013

Qualifications

SUP 3.4.2

See Notes

- 21/06/2001

- Future version of SUP 3.4.2 after 06/06/2008

SUP 3.4.3

See Notes

- 21/06/2001

- Future version of SUP 3.4.3 after 01/04/2013

SUP 3.4.4

See Notes

- 21/06/2001

- Future version of SUP 3.4.4 after 01/04/2013

Disqualified auditors

SUP 3.4.5

See Notes

- 21/06/2001

- Future version of SUP 3.4.5 after 01/04/2013

SUP 3.4.6

See Notes

- 21/06/2001

- Future version of SUP 3.4.6 after 28/08/2007

Requests for information on qualifications by the FSA

SUP 3.4.7

See Notes

- 21/06/2001

- Future version of SUP 3.4.7 after 01/04/2013

SUP 3.4.8

See Notes

- 21/06/2001

- Future version of SUP 3.4.8 after 01/04/2013

SUP 3.5

Auditors' independence

- 01/12/2004

Purpose

SUP 3.5.1

See Notes

- 21/06/2001

- Future version of SUP 3.5.1 after 06/06/2008

Independence

SUP 3.5.2

See Notes

- 21/06/2001

- Future version of SUP 3.5.2 after 01/04/2013

SUP 3.5.3

See Notes

- 21/06/2001

- Future version of SUP 3.5.3 after 01/04/2013

SUP 3.5.4

See Notes

- 21/06/2001

- Future version of SUP 3.5.4 after 01/04/2013

SUP 3.5.5

See Notes

- 21/06/2001

- Future version of SUP 3.5.5 after 06/06/2008

SUP 3.6

Firms' cooperation with their auditors

- 01/12/2004

SUP 3.6.1

See Notes

- 21/06/2001

- Future version of SUP 3.6.1 after 01/04/2013

Auditor's access to accounting records

SUP 3.6.2

See Notes

- 21/06/2001

- Future version of SUP 3.6.2 after 01/04/2013

SUP 3.6.3

See Notes

- 21/06/2001

- Future version of SUP 3.6.3 after 01/04/2013

SUP 3.6.4

See Notes

- 21/06/2001

- Future version of SUP 3.6.4 after 06/06/2008

SUP 3.6.5

See Notes

- 21/06/2001

- Future version of SUP 3.6.5 after 01/04/2013

Access and cooperation: appointed representatives, material outsourcing, employees

SUP 3.6.6

See Notes

- 21/06/2001

- Future version of SUP 3.6.6 after 01/11/2007

SUP 3.6.7

See Notes

- 21/06/2001

- Future version of SUP 3.6.7 after 01/04/2013

SUP 3.6.8

See Notes

- 21/06/2001

- Future version of SUP 3.6.8 after 01/04/2013

Provision of false or misleading information to auditors

SUP 3.6.9

See Notes

- 21/06/2001

- Future version of SUP 3.6.9 after 01/04/2013

SUP 3.7

Notification of matters raised by auditor

- 01/12/2004

Application

SUP 3.7.1

See Notes

- 21/06/2001

- Future version of SUP 3.7.1 after 01/04/2013

Notification

SUP 3.7.2

See Notes

- 21/06/2001

- Future version of SUP 3.7.2 after 01/04/2013

SUP 3.8

Rights and duties of auditors

- 01/12/2004

Purpose

SUP 3.8.1

See Notes

- 21/06/2001

- Future version of SUP 3.8.1 after 01/04/2013

Cooperation with the FSA

SUP 3.8.2

See Notes

- 21/06/2001

- Future version of SUP 3.8.2 after 01/04/2013

SUP 3.8.3

See Notes

- 21/06/2001

- Future version of SUP 3.8.3 after 01/04/2013

SUP 3.8.4

See Notes

- 21/06/2001

- Future version of SUP 3.8.4 after 01/04/2013

Auditor's independence

SUP 3.8.5

See Notes

- 21/06/2001

- Future version of SUP 3.8.5 after 01/04/2013

SUP 3.8.6

See Notes

- 21/06/2001

- Future version of SUP 3.8.6 after 01/04/2013

SUP 3.8.7

See Notes

- 21/06/2001

- Future version of SUP 3.8.7 after 01/04/2013

Auditors' rights to information

SUP 3.8.8

See Notes

- 21/06/2001

- Future version of SUP 3.8.8 after 06/06/2008

Communication between the FSA, the firm and the auditor

SUP 3.8.9

See Notes

- 21/06/2001

- Future version of SUP 3.8.9 after 01/04/2013

Auditors' statutory duty to report

SUP 3.8.10

See Notes

Termination of term of office, disqualification

SUP 3.8.11

See Notes

SUP 3.8.12

See Notes

SUP 3.9

Duties of auditors: reports on certain investment business firms

- 01/12/2004

Purpose

SUP 3.9.1

See Notes

- 21/06/2001

Application

SUP 3.9.2

See Notes

- 21/06/2001

SUP 3.9.3

See Notes

- 21/06/2001

The auditor's report: content

SUP 3.9.4

See Notes

- 21/06/2001

SUP 3.9.5

See Notes

Auditor's report

| whether the auditor has: | ||

| (1) | audited the firm's annual financial statements in accordance with International Standards on Auditing (UK and Ireland) issued by the Auditing Practices Board; | |

| (2) | carried out such other procedures as he considered necessary, having regard to the relevant Auditing Practices Board's Practice Note; and | |

| (3) | obtained all the information and explanations which to the best of his knowledge and belief are necessary for the purposes of his report to the FSA; and | |

| whether in the auditor's opinion: | ||

| (4) | except in the case of an OPS firm, the audited annual financial statements of the firm give a true and fair view: | |

| (a) | in the case of the profit and loss account, of the firm's profit or loss for the period to which that account relates; and | |

| (b) | in the case of the annual balance sheet, of the state of the affairs of the firm at the accounting reference date at which that balance sheet was prepared; | |

| (5) | in the case of an OPS firm, the audited annual financial statements give a true and fair view of the state of affairs: | |

| (a) | in the case of the statements of the firm, of the firm at theaccounting reference date of the firm; and | |

| (b) | in the case of any OPS collective investment scheme in relation to which the firm carries on OPS activities, of the OPS collective investment scheme at the accounting reference date of the scheme; | |

| (6) | the relevant financial reporting statement has been properly prepared in accordance with the FSA's rules , the relevant financial reporting statement being, in the case of: | |

| (a) | an investment management firm: the annual financial return (see SUP 16.7.36 R); or | |

| (b) | a personal investment firm: the annual financial statement (see SUP 16.7.45 R ) ; or | |

| (c) | a securities and futures firm: the annual reporting statement (SUP 16.7.25 R or SUP 16.7.27 R); | |

| (d) | a UCITS management company: the annual financial return (see SUP 16.7.68 R); | |

| (7) | the balance sheet and the profit and loss account of the relevant financial reporting statement in (6) are in agreement with the firm's accounting records and returns ; | |

| (8) | in the case of: | |

| (a) | a personal investment firm; or | |

| (b) | a securities and futures firm; | |

| the balance sheet of the relevant financial reporting statement in (6) has been properly reconciled to the quarterly reporting statement or monthly reporting statement prepared as at the same accounting reference date; | ||

| (9) | in the case of a securities and futures firm, the balance sheet of the annual reporting statement has been properly reconciled to the balance sheet of the audited annual financial statements; | |

| (10) | the firm (not being a corporate finance advisory firm or an OPS firm) has calculated its expenditure requirement in accordance with the relevant rules for the forthcoming year, the relevant rules being, in the case of: | |

| (a) | an investment management firm: IPRU(INV) 5.2.3R (4), IPRU(INV) 5.2.4R; | |

| (b) | a category A personal investment firm (see SUP 3.9.6 R): IPRU(INV) 13.2R and IPRU(INV) 13.5R; | |

| (c) | a category B personal investment firm (see SUP 3.9.6 R, IPRU(INV) 13.9R and IPRU(INV) 13.12R); | |

| (d) | a securities and futures firm which is not an ISD investment firm: IPRU(INV) 3-70R, IPRU(INV) 3-71R and IPRU(INV) 3-73R; | |

| (e) | a securities and futures firm which is an ISD investment firm: IPRU(INV)10-71R, IPRU(INV)10-72R and IPRU(INV) 10-73R; | |

| (f) | a UCITS management company: IPRU(INV) 7.2.3R and IPRU(INV) 7.2.4R; | |

| (11) | the firm's statement of financial resources, and the firm's statement of financial resources requirement, have been properly prepared in accordance with the rules; | |

| (12) | the firm's financial resources at the accounting reference date are sufficient to meet the firm's financial resources requirement; | |

| (13) | the firm has kept proper accounting records in accordance with the rules throughout its financial year, the relevant rules being, in the case of: | |

| (a) | an investment management firm: IPRU(INV) 5.3.1R; | |

| (b) | a personal investment firm: IPRU(INV) 13.1.11-13.1.16R | |

| (c) | a securities and futures firm which is not an ISD investment firm: IPRU(INV) 3-10R; | |

| (d) | a securities and futures firm which is an ISD investment firm IPRU(INV) 10-10R; (except IPRU(INV) 10-10R(3)(m)-(n)) | |

| (e) | a UCITS management company: IPRU(INV) 7.4.1R; | |

| (14) | if the firm prepares a consolidated supervision return at its accounting reference date, that it has been prepared in accordance with the rules. | |

SUP 3.9.6

See Notes

- 21/06/2001

- Future version of SUP 3.9.6 after 01/11/2007

The auditor's report: timing of submission

SUP 3.9.7

See Notes

- 13/02/2004

SUP 3.9.8

See Notes

- 21/06/2001

The auditor's report: requirements not met or inability to form opinion

SUP 3.9.9

See Notes

- 21/06/2001

Method of submission of reports

SUP 3.9.10

See Notes

- 21/06/2001

Service of Notice Regulations

SUP 3.9.11

See Notes

- 21/06/2001

SUP 3.10

Duties of auditors: notification and report on client assets

- 01/12/2004

Application

SUP 3.10.1

See Notes

- 21/06/2001

SUP 3.10.2

See Notes

SUP 3.10.3

See Notes

- 21/06/2001

Client assets report: content

SUP 3.10.4

See Notes

SUP 3.10.5

See Notes

Client assets report

| Whether in the auditor's opinion | ||

| (1) | the firm has maintained systems adequate to enable it to comply with the rules in CASS 2 to CASS 4 (inclusive) and CASS 5.1 to CASS 5.8 (except CASS 5.2) throughout the period since the last date as at which a report was made; | |

| (2) | the firm was in compliance with the rules in CASS 2 to CASS 4 (inclusive) and CASS 5 (except CASS 5.2), at the date as at which the report has been made; | |

| (3) | in the case of an investment management firm, personal investment firm, a UCITS management company or securities and futures firm , when a subsidiary of the firm is a nominee company in whose name custody assets of the firm are registered that nominee company has maintained throughout the year systems for the custody, identification and control of custody assets which: | |

| (a) | are adequate; and | |

| (b) | include reconciliations at appropriate intervals between the records maintained (whether by the firm or the nominee company) and statements or confirmations from custodians or from the person who maintains the record of legal entitlement; and | |

| (4) | if there has been a secondary pooling event during the period, the firm has complied with the rulesCASS 4.4, and CASS 5.6 (Client money distribution) in relation to that pooling event. | |

Client assets report: period covered

SUP 3.10.6

See Notes

Client assets report: timing of submission

SUP 3.10.7

See Notes

SUP 3.10.8

See Notes

SUP 3.10.8A

See Notes

- 01/04/2005

SUP 3.10.8B

See Notes

- 01/04/2005

SUP 3.10.8C

See Notes

- 01/04/2005

Client assets report: requirements not met or inability to form opinion

SUP 3.10.9

See Notes

SUP 3.10.10

See Notes

- 21/06/2001

SUP 3.10.11

See Notes

- 21/06/2001

Method of submission of reports

SUP 3.10.12

See Notes

- 21/06/2001

Service of Notice Regulations

SUP 3.10.13

See Notes

- 21/06/2001

SUP 4

Actuaries

SUP 4.1

Application

- 31/12/2004

SUP 4.1.1

See Notes

- 31/12/2004

- Future version of SUP 4.1.1 after 01/04/2013

SUP 4.1.2

See Notes

- 01/01/2005

- Future version of SUP 4.1.2 after 01/04/2013

SUP 4.1.3

See Notes

Applicable sections

| (1) | Category of firm | (2) Applicable sections | |

| (1) | A long-term insurer, other than: | SUP 4.1, SUP 4.2, SUP 4.3 and SUP 4.5 | |

| (a) | a registered friendly society which is a non-directive friendly society; | ||

| (b) | an incorporated friendly society that is a flat rate benefits business friendly society; and | ||

| (c) | an incoming EEA firm | ||

| (2) | A friendly society, other than a friendly society within (1). | SUP 4.1, SUP 4.2, SUP 4.4 and SUP 4.5 | |

| (3) | A Lloyd's managing agent, in respect of each syndicate it manages | SUP 4.1, SUP 4.2, SUP 4.5, SUP 4.6 | |

| (4) | The Society of Lloyd's | SUP 4.1, SUP 4.2, SUP 4.5, SUP 4.6 | |

SUP 4.2

Purpose

- 31/12/2004

SUP 4.2.1

See Notes

- 31/12/2004

- Future version of SUP 4.2.1 after 01/04/2013

SUP 4.2.2

See Notes

This chapter defines the relationship between firms and their actuaries and clarifies the role which actuaries play in the FSA's monitoring of firms' compliance with the requirements and standards under the regulatory system. The chapter sets out rules and guidance on the appointment of actuaries, and the termination of their term of office, as well as setting out their respective rights and duties. The purpose of the chapter is to ensure that:

- (1) long-term insurers (other than certain friendly societies) have access to adequate actuarial advice, both in valuing their liabilities to policyholders and in exercising discretion affecting the interests of their with-profits policyholders; and

- (2) other friendly societies carrying on insurance business (and which have traditionally relied upon actuarial expertise) employ or use an actuary of appropriate seniority and experience to evaluate the liabilities of that business; and

- (3) managing agents of Lloyd's syndicates employ or use an actuary of appropriate seniority and experience to evaluate the liabilities associated with insurance business carried on at Lloyd's.

- 01/01/2005

- Future version of SUP 4.2.2 after 01/04/2013

SUP 4.2.3

See Notes

- 31/12/2004

- Future version of SUP 4.2.3 after 01/04/2013

SUP 4.2.4

See Notes

- 31/12/2004

- Future version of SUP 4.2.4 after 01/04/2013

SUP 4.2.5

See Notes

- 31/12/2004

- Future version of SUP 4.2.5 after 01/04/2013

SUP 4.2.6

See Notes

- 31/12/2004

- Future version of SUP 4.2.6 after 01/04/2013

SUP 4.3

Appointment of actuaries

- 31/12/2004

Appointment by firms

SUP 4.3.1

See Notes

- 31/12/2004

- Future version of SUP 4.3.1 after 01/04/2013

SUP 4.3.2

See Notes

- 31/12/2004

- Future version of SUP 4.3.2 after 01/04/2013

Appointment by the FSA

SUP 4.3.3

See Notes

- 31/12/2004

- Future version of SUP 4.3.3 after 01/04/2013

SUP 4.3.4

See Notes

- 31/12/2004

- Future version of SUP 4.3.4 after 01/04/2013

SUP 4.3.5

See Notes

- 31/12/2004

- Future version of SUP 4.3.5 after 01/04/2013

SUP 4.3.6

See Notes

- 31/12/2004

- Future version of SUP 4.3.6 after 01/04/2013

SUP 4.3.7

See Notes

- 31/12/2004

- Future version of SUP 4.3.7 after 01/04/2013

Actuaries' qualifications

SUP 4.3.8

See Notes

- 31/12/2004

- Future version of SUP 4.3.8 after 01/04/2013

SUP 4.3.9

See Notes

- 31/12/2004

- Future version of SUP 4.3.9 after 01/04/2013

SUP 4.3.10

See Notes

Disqualified actuaries

SUP 4.3.11

See Notes

SUP 4.3.12

See Notes

SUP 4.3.12A

See Notes

SUP 4.3.12B

See Notes

The actuarial function

SUP 4.3.13

See Notes

An actuary appointed to perform the actuarial function must, in respect of those classes of the firm's long-term insurance business which are covered by his appointment:

- (1) advise the firm's management, at the level of seniority that is reasonably appropriate, on the risks the firm runs in so far as they may have a material impact on the firm's ability to meet liabilities to policyholders in respect of long-term insurance contracts as they fall due and on the capital needed to support the business, including regulatory capital requirements;

- (2) monitor those risks and inform the firm's management, at the level of seniority that is reasonably appropriate, if he has any material concerns or good reason to believe that the firm:

- (a) is not meeting liabilities to policyholders under long-term insurance contracts as they fall due, or may not be doing so, or might not have done so, or might, in reasonably foreseeable circumstances, not do so;

- (b) is, or may be, effecting new long-term insurance contracts on terms under which the resulting income earned is insufficient, under reasonable actuarial methods and assumptions, and taking into account the other financial resources that are available for the purpose, to enable the firm to meet its liabilities to policyholders as they fall due (including reasonable bonus expectations);

- (c) does not, or may not, have sufficient financial resources to meet liabilities to policyholders as they fall due (including reasonable bonus expectations) and the capital needed to support the business, including regulatory capital requirements or, if the firm currently has sufficient resources, might, in reasonably foreseeable circumstances, not continue to have them;

- (3) advise the firm's governing body on the methods and assumptions to be used for the investigations required by IPRU(INS) 9.4R or IPRU(FSOC) 5.1R and the calculation of the with-profits insurance capital component under PRU 7.4 as applicable;

- (4) perform those investigations and calculations in (3), in accordance with the methods and assumptions determined by the firm's governing body;

- (5) report to the firm's governing body on the results of those investigations and calculations in (3); and

- (6) in the case of a friendly society to which this section applies, perform the functions of the appropriate actuary under section 87 (Actuary's report as to margin of solvency) of the Friendly Societies Act 1992.

SUP 4.3.14

See Notes

SUP 4.3.15

See Notes

The with-profits actuary function

SUP 4.3.16A

See Notes

An actuary appointed to perform the with-profits actuary function must:

- (1) advise the firm's management, at the level of seniority that is reasonably appropriate, on key aspects of the discretion to be exercised affecting those classes of the with-profits business of the firm in respect of which he has been appointed;

- (2) where the firm is a realistic basis life firm advise the firm's governing body as to whether the assumptions used to calculate the with-profits insurance component under PRU 7.4 are consistent with the firm's PPFM in respect of those classes of the firm's with-profits business;

- (3) at least once a year, in respect of each financial year commencing on or after 1 January 2005, report to the firm's governing body on key aspects (including those aspects of the firm's application of its Principles and Practices of Financial Management on which the advice described in (1) has been given) of the discretion exercised in respect of the period covered by his report affecting those classes of with-profits business of the firm;

- (4) in respect of each financial year commencing on or after 1 January 2005, make a written report addressed to the relevant classes of the firm's with-profits policyholders, to accompany the firm's annual report under COB 6.11.9 R, as to whether, in his opinion and based on the information and explanations provided to him by the firm, the annual report and the discretion exercised by the firm in respect of the period covered by the report may be regarded as taking, or having taken, the interests of the relevant classes of the firm'swith-profits policyholders into account in a reasonable and proportionate manner;

- (5) request from the firm such information and explanations as he reasonably considers necessary to enable him properly to perform the duties in (1) to (4);

- (6) advise the firm as to the data and systems that he reasonably considers necessary to be kept and maintained to provide the duties in (5); and

- (7) in the case of a friendly society to which this section applies, perform the function of appropriate actuary under section 12 (Reinsurance) of the Friendly Societies Act 1992 or section 23A (Reinsurance) of the Friendly Societies Act 1974 as applicable, in respect of those classes of its with-profits business covered by his appointment.

SUP 4.3.16B

See Notes

SUP 4.3.16C

See Notes

SUP 4.3.16D

See Notes

- 31/12/2004

SUP 4.3.17

See Notes

SUP 4.3.18

See Notes

- 31/12/2004

SUP 4.4

Appropriate actuaries

- 01/12/2004

Appointment of an appropriate actuary

SUP 4.4.1

See Notes

- 21/06/2001

- Future version of SUP 4.4.1 after 01/04/2013

Appropriate actuaries' qualifications

SUP 4.4.2

See Notes

- 21/06/2001

- Future version of SUP 4.4.2 after 01/04/2013

SUP 4.4.3

See Notes

- 21/06/2001

- Future version of SUP 4.4.3 after 01/04/2013

SUP 4.4.4

See Notes

- 21/06/2001

- Future version of SUP 4.4.4 after 01/04/2013

SUP 4.4.5

See Notes

- 31/12/2004

- Future version of SUP 4.4.5 after 28/08/2007

Specific duties of the appropriate actuary

SUP 4.4.6

See Notes

- 31/12/2004

- Future version of SUP 4.4.6 after 01/04/2013

SUP 4.5

Provisions applicable to all actuaries

- 31/12/2004

Objectivity

SUP 4.5.1

See Notes

- 31/12/2004

- Future version of SUP 4.5.1 after 01/04/2013

SUP 4.5.2

See Notes

- 31/12/2004

- Future version of SUP 4.5.2 after 01/04/2013

SUP 4.5.3

See Notes

- 31/12/2004

- Future version of SUP 4.5.3 after 01/04/2013

SUP 4.5.4

See Notes

- 31/12/2004

- Future version of SUP 4.5.4 after 01/04/2013

SUP 4.5.5

See Notes

- 31/12/2004

- Future version of SUP 4.5.5 after 01/04/2013

SUP 4.5.6

See Notes

- 31/12/2004

- Future version of SUP 4.5.6 after 01/04/2013

Actuaries' statutory duty to report

SUP 4.5.7

See Notes

- 01/01/2005

- Future version of SUP 4.5.7 after 06/05/2009

Termination of term of office

SUP 4.5.8

See Notes

- 31/12/2004

- Future version of SUP 4.5.8 after 01/04/2013

SUP 4.5.9

See Notes

- 31/12/2004

- Future version of SUP 4.5.9 after 01/04/2013

SUP 4.5.10

See Notes

SUP 4.5.11

See Notes

Rights and duties

SUP 4.5.13

See Notes

SUP 4.5.14

See Notes

SUP 4.6

Lloyd's

- 01/01/2005

Appointment of the Lloyd's actuary and syndicate actuaries

SUP 4.6.1

See Notes

- 01/01/2005

- Future version of SUP 4.6.1 after 01/11/2007

SUP 4.6.2

See Notes

- 01/01/2005

- Future version of SUP 4.6.2 after 01/04/2013

Qualifications

SUP 4.6.3

See Notes

- 01/01/2005

- Future version of SUP 4.6.3 after 01/04/2013

SUP 4.6.4

See Notes

and seek confirmation of these from the actuary, or the actuary's current and previous employers, as appropriate.

- 01/01/2005

- Future version of SUP 4.6.4 after 01/04/2013

Disqualified actuaries

SUP 4.6.5

See Notes

- 01/01/2005

- Future version of SUP 4.6.5 after 01/04/2013

SUP 4.6.6

See Notes

- 01/01/2005

- Future version of SUP 4.6.6 after 28/08/2007

Conflicts of interest

SUP 4.6.7

See Notes

- 01/01/2005

- Future version of SUP 4.6.7 after 01/04/2013

The Lloyd's actuary function

SUP 4.6.8

See Notes

- 01/01/2005

- Future version of SUP 4.6.8 after 31/12/2006

Appointment of syndicate actuaries

SUP 4.6.9

See Notes

- 01/01/2005

- Future version of SUP 4.6.9 after 01/04/2013

SUP 4.6.10

See Notes

and references to an actuary of a firm should be read accordingly.

Syndicate actuaries' qualifications

SUP 4.6.11

See Notes

SUP 4.6.12

See Notes

and seeks confirmation of these from the syndicate actuary, or the syndicate actuary's current and previous employers, as appropriate.

Disqualified actuaries

SUP 4.6.13

See Notes

SUP 4.6.14

See Notes

Duties of syndicate actuaries

SUP 4.6.15

See Notes

SUP 4.6.16

See Notes

SUP 4.6.17

See Notes

SUP 4.6.18

See Notes

SUP 4.6.19

See Notes

SUP 5

Reports by skilled persons

SUP 5.1

Application and purpose

- 01/12/2004

Application

SUP 5.1.1

See Notes

- 21/06/2001

- Future version of SUP 5.1.1 after 01/04/2013

SUP 5.1.2

See Notes

- 21/06/2001

- Future version of SUP 5.1.2 after 01/04/2013

Purpose

SUP 5.1.3

See Notes

- 21/06/2001

- Future version of SUP 5.1.3 after 01/04/2013

SUP 5.2

The FSA's power

- 01/12/2004

- Future version of SUP 5.2 after 01/04/2013

Who may be required to provide a report?

SUP 5.2.1

See Notes

- 21/06/2001

- Future version of SUP 5.2.1 after 01/04/2013

SUP 5.3

Policy on the use of skilled persons

- 01/12/2004

SUP 5.3.1

See Notes

- 21/06/2001

- Future version of SUP 5.3.1 after 01/04/2013

SUP 5.3.2

See Notes

- 21/06/2001

- Future version of SUP 5.3.2 after 31/12/2007

SUP 5.3.3

See Notes

- 21/06/2001

- Future version of SUP 5.3.3 after 01/04/2013

Circumstances relating to the firm

SUP 5.3.4

See Notes

- 21/06/2001

- Future version of SUP 5.3.4 after 01/04/2013

Alternative tools available, including other statutory powers

SUP 5.3.5

See Notes

- 21/06/2001

- Future version of SUP 5.3.5 after 28/08/2007

Legal and procedural considerations

SUP 5.3.6

See Notes

- 21/06/2001

- Future version of SUP 5.3.6 after 01/04/2013

The objectives of the FSA's enquiries

SUP 5.3.7

See Notes

- 21/06/2001

- Future version of SUP 5.3.7 after 01/04/2013

Cost considerations

SUP 5.3.8

See Notes

- 21/06/2001

- Future version of SUP 5.3.8 after 01/04/2013

SUP 5.3.9

See Notes

- 21/06/2001

- Future version of SUP 5.3.9 after 01/04/2013

Considerations relating to FSA resources

SUP 5.4

Appointment and reporting process

- 01/12/2004

Scope of report

SUP 5.4.1

See Notes

- 21/06/2001

- Future version of SUP 5.4.1 after 01/04/2013

SUP 5.4.2

See Notes

- 21/06/2001

- Future version of SUP 5.4.2 after 01/04/2013

SUP 5.4.3

See Notes

- 21/06/2001

- Future version of SUP 5.4.3 after 01/04/2013

SUP 5.4.4

See Notes

- 21/06/2001

- Future version of SUP 5.4.4 after 01/04/2013

SUP 5.4.5

See Notes

- 21/06/2001

- Future version of SUP 5.4.5 after 01/04/2013

Appointment process

SUP 5.4.6

See Notes

- 21/06/2001

- Future version of SUP 5.4.6 after 01/04/2013

SUP 5.4.7

See Notes

- 21/06/2001

- Future version of SUP 5.4.7 after 01/04/2013

SUP 5.4.8

See Notes

- 21/06/2001

- Future version of SUP 5.4.8 after 01/04/2013

SUP 5.4.9

See Notes

- 21/06/2001

- Future version of SUP 5.4.9 after 01/04/2013

Reporting process

SUP 5.4.10

See Notes

SUP 5.4.11

See Notes

SUP 5.4.12

See Notes

SUP 5.4.13

See Notes

SUP 5.5

Duties of firms

- 01/12/2004

Contract with the skilled person

SUP 5.5.1

See Notes

- 21/06/2001

- Future version of SUP 5.5.1 after 01/04/2013

SUP 5.5.2

See Notes

- 21/06/2001

- Future version of SUP 5.5.2 after 01/04/2013

SUP 5.5.3

See Notes

- 21/06/2001

- Future version of SUP 5.5.3 after 01/04/2013

SUP 5.5.4

See Notes

- 21/06/2001

- Future version of SUP 5.5.4 after 01/04/2013

SUP 5.5.5

See Notes

- 21/06/2001

- Future version of SUP 5.5.5 after 01/04/2013

SUP 5.5.6

See Notes

- 21/06/2001

- Future version of SUP 5.5.6 after 01/04/2013

SUP 5.5.7

See Notes

- 21/06/2001

- Future version of SUP 5.5.7 after 01/04/2013

SUP 5.5.8

See Notes

- 21/06/2001

- Future version of SUP 5.5.8 after 01/04/2013

Assisting the skilled person

SUP 5.5.9

See Notes

- 21/06/2001

- Future version of SUP 5.5.9 after 01/04/2013

SUP 5.5.10

See Notes

SUP 5.5.11

See Notes

Responsibility for delivery

SUP 5.5.12

See Notes

Assistance to skilled persons from others

SUP 5.5.13

See Notes

SUP 5.6

Confidential information and privilege

- 01/12/2004

Confidential information

SUP 5.6.1

See Notes

- 21/06/2001

- Future version of SUP 5.6.1 after 01/04/2013

Banking confidentiality and legal privilege

SUP 5.6.2

See Notes

- 21/06/2001

- Future version of SUP 5.6.2 after 01/04/2013

SUP 5 Annex 1

Examples of when the FSA may use the skilled person tool (This Annex belongs to SUP 5.3.1G)

- 01/12/2004

See Notes

| Toolkit purpose | Purpose for use of tool | Examples of reasons for use of tool |

| Diagnostic | • To find out more about a concern (e.g. the result of a visit, risk assessment, or notification) and determine whether action is needed to mitigate a risk to the regulatory objectives or to determine whether there may have been a breach of a rule or of a threshold condition. • To assess the implications of, and firm's* response to, a change of circumstances e.g. - proposed entry into new business area; - new control structure; - merger or take-over; - new IT system; or - launch of an E-Commerce venture. | • Concern about effectiveness of the firm's* internal audit department. • Concern about reliability of submitted financial returns. • Inability of a firm* to quantify its current financial position. • Assessment of consequences of incomplete customer files. • Concern about quality of systems and controls. • Indication of financial crime or money laundering. • Concern about a firm's* controller. • Assessment of control structure when a bank (specialising in consumer lending) diversifies into commercial lending. |

| Diagnostic/monitoring | • To verify information provided to the FSA. | • Verification of a specific return to give the FSA assurance of the quality of information provided. |

| Monitoring | • To review systems and controls • To complement baseline monitoring | • Assessment of systems and controls in firms* where identified as a risk mitigation priority. • In-depth review of part of a firm* which is material to the firm's risk profile but of which the FSA does not consider it has an adequate, up-to-date understanding. |

| Preventative | • To gather and analyse information on an identified risk and develop recommendations for resolution. | Review of identified control weaknesses over client money to obtain recommendations to ensure compliance with the relevant rules. |

| Remedial | • To assist in the design of a customer redress programme. • To assist in the design of a remedial action plan. • To oversee and report on remedial action plan. | • Where possible, the

FSA

has identified possible losses from failure to reconcile assets or from mis-posting of transactions to the general ledger. • To report on quality of work undertaken and adherence to milestones in the action plan. |

| * or, where applicable, the other persons in SUP 5.2.1 G. | ||

- 21/06/2001

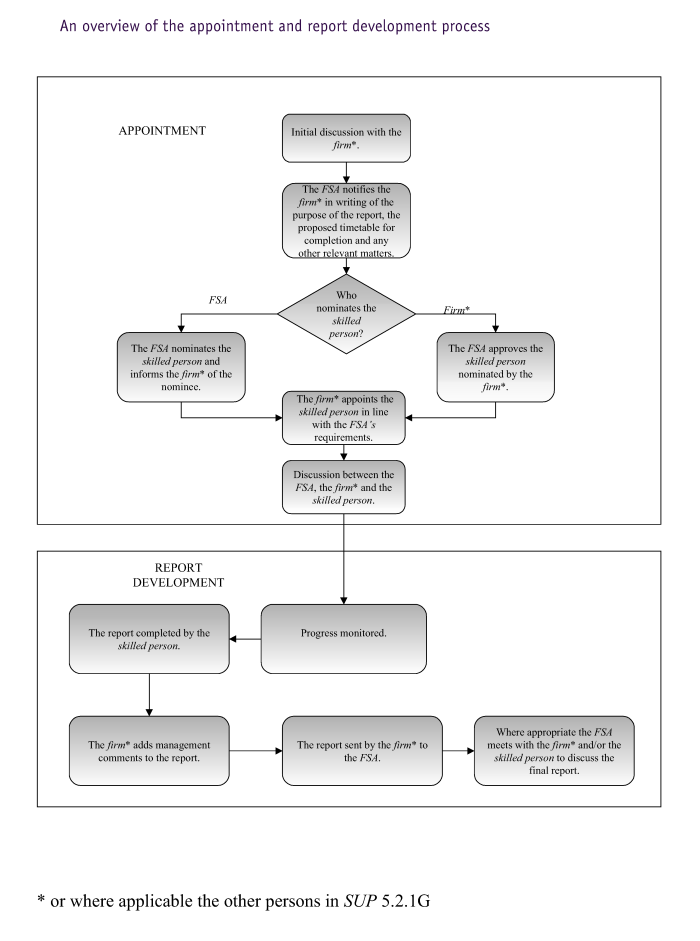

SUP 5 Annex 2

An overview of the appointment and report development process

- 01/12/2004

See Notes

- 21/06/2001

Export chapter as

SUP 6

Applications to vary and cancel Part IV permission

SUP 6.1

Application and purpose

- 01/12/2004

- Future version of SUP 6.1 after 01/04/2013

Application

SUP 6.1.1

See Notes

- 21/06/2001

- Future version of SUP 6.1.1 after 01/04/2013

SUP 6.1.2

See Notes

- 01/04/2004

- Future version of SUP 6.1.2 after 01/04/2009

SUP 6.1.3

See Notes

- 21/06/2001

- Future version of SUP 6.1.3 after 01/04/2013

Purpose

SUP 6.1.4

See Notes

- 21/06/2001

- Future version of SUP 6.1.4 after 01/04/2013

SUP 6.1.5

See Notes

- 21/06/2001

- Future version of SUP 6.1.5 after 28/08/2007

SUP 6.2

Introduction

- 01/12/2004

SUP 6.2.1

See Notes

- 21/06/2001

- Future version of SUP 6.2.1 after 06/10/2007

SUP 6.2.2

See Notes

- 21/06/2001

- Future version of SUP 6.2.2 after 01/04/2013

SUP 6.2.3

See Notes

- 21/06/2001

SUP 6.2.4

See Notes

- 21/06/2001

- Future version of SUP 6.2.4 after 01/04/2013

SUP 6.2.5

See Notes

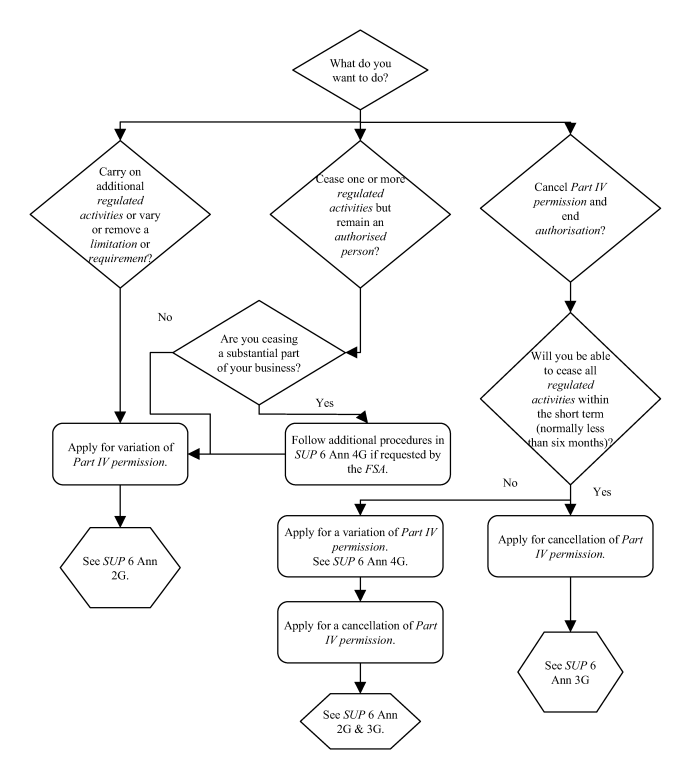

Variation and cancellation of Part IV permission. See ofSUP 6.2.3 G

| Question | Variation of Part IV permission | Cancellation of Part IV permission |

| What does the application apply to? | Individual elements of a firm's Part IV permission. Variations may involve adding or removing categories of regulated activity or specified investments or varying or removing any limitations or requirements in the firm's Part IV permission. | A firm's entire Part IV permission and not individual elements within it. |

| In what circumstances is it usually appropriate to make an application? | If a firm: 1. wishes to change the regulated activities it carries on in the United Kingdom under a Part IV permission (SUP 6.3); or 2. has the ultimate intention of ceasing carrying on regulated activities but due to the nature of those regulated activities (for example, accepting deposits, or insurance business) it will require a long term (normally over six months) to wind down (run off) its business (see SUP 6.2.8 G to SUP 6.2.11 G and SUP 6 Annex 4). | If a firm: 1. has ceased to carry on all of the regulated activities for which it has Part IV permission (SUP 6.4); or 2. wishes or expects to cease carrying on all of the regulated activities for which it has Part IV permission in the short term (normally not more than six months). In this case, the firm may apply to cancel its Part IV permission prior to ceasing the regulated activities (see SUP 6.4.3 G). |

| Where do I find a summary of the application procedures? | See SUP 6 Annex 2 . | See SUP 6 Annex 3. |

- 21/06/2001

- Future version of SUP 6.2.5 after 01/04/2013

SUP 6.2.6

See Notes

- 21/06/2001

- Future version of SUP 6.2.6 after 01/04/2013

SUP 6.2.7

See Notes

- 21/06/2001

- Future version of SUP 6.2.7 after 01/04/2013

Firms with long term liabilities to customers

SUP 6.2.8

See Notes

- 21/06/2001

- Future version of SUP 6.2.8 after 06/08/2009

SUP 6.2.9

See Notes

- 21/06/2001

- Future version of SUP 6.2.9 after 06/08/2009

SUP 6.2.10

See Notes

SUP 6.2.11

See Notes

UK firms exercising EEA or Treaty rights

SUP 6.2.12

See Notes

SUP 6.2.13

See Notes

The Lloyd's market

SUP 6.2.14

See Notes

SUP 6.3

Applications for variation of permission

- 01/12/2004

- Future version of SUP 6.3 after 01/04/2013

What is a variation of permission?

SUP 6.3.1

See Notes

- 21/06/2001

SUP 6.3.2

See Notes

- 21/06/2001

SUP 6.3.3

See Notes

- 21/06/2001

- Future version of SUP 6.3.3 after 06/10/2007

Applications to add additional regulated activities

SUP 6.3.4

See Notes

- 21/06/2001

- Future version of SUP 6.3.4 after 01/04/2013

SUP 6.3.5

See Notes

- 21/06/2001

- Future version of SUP 6.3.5 after 06/10/2007

SUP 6.3.6

See Notes

- 21/06/2001

- Future version of SUP 6.3.6 after 01/04/2013

Applications to remove certain regulated activities

SUP 6.3.7

See Notes

- 21/06/2001

- Future version of SUP 6.3.7 after 01/04/2013

How a variation of permission may affect the firm's approved persons

SUP 6.3.8

See Notes

- 21/06/2001

- Future version of SUP 6.3.8 after 01/11/2007

How a variation of permission may change a firm's prudential category

SUP 6.3.9

See Notes

- 21/06/2001

SUP 6.3.10

See Notes

- 21/06/2001

Variation of permission involving insurance business

SUP 6.3.11

See Notes

SUP 6.3.12

See Notes

SUP 6.3.13

See Notes

SUP 6.3.14

See Notes

The application for variation of permission

SUP 6.3.15

See Notes

- (1) If a firm wishes to apply for a variation of Part IV permission, it must complete and submit to the FSA the form in SUP 6 Annex 5 (Variation of permission application form).

- (2) A firm's application for variation of Part IV permission must be given or addressed, and delivered in the way set out in SUP 15.7.4 R to SUP 15.7.6 G (Form and method of notification).

- (3) Until the application has been determined, a firm which submits an application for variation of Part IV permission must inform the FSA of any significant change to the information given in the application immediately it becomes aware of the change.

SUP 6.3.16

See Notes

SUP 6.3.17

See Notes

SUP 6.3.18

See Notes

Applications from firms winding down (running off) business over the long term

SUP 6.3.19

See Notes

Applications involving significant changes

SUP 6.3.20

See Notes

SUP 6.3.21

See Notes

SUP 6.3.22

See Notes

SUP 6.3.22A

See Notes

- 01/06/2004

SUP 6.3.22B

See Notes

- 01/06/2004

SUP 6.3.22C

See Notes

- 01/06/2004

Information to be supplied to the FSA as part of the application

SUP 6.3.23

See Notes

SUP 6.3.24

See Notes

SUP 6.3.25

See Notes

Information which may be required. See SUP 6.3.24 G

| Type of business | Information which may be required |

| All | 1. Details of how the firm plans to comply with the FSA's regulatory requirements relating to any additional regulated activities it is seeking to carry on. |

| 2. Descriptions of the firm's key controls, senior management arrangements and audit and proposed compliance arrangements in respect of any new regulated activity (see SYSC). | |

| 3. Organisation charts and details of individuals transferring or being recruited to perform new controlled functions (see SUP 10 for details of the application or transfer procedures under the approved persons regime). | |

| Insurance business | 1. A scheme of operations in accordance with SUP App 2. |

| 2. (If the application seeks to vary a permission to include motor vehicle liability insurance business) details of the claims representatives required by threshold condition2A (Appointment of claims representatives), if applicable. | |

| Accepting deposits and designated investment business | 1. A business plan which includes the impact of the variation on the firm's existing or continuing business financial projections for the firm, including the impact of the requested variation of Part IV permission on the firm's financial resources and capital adequacy requirements. |

SUP 6.3.26

See Notes

SUP 6.3.27

See Notes

When will the FSA grant an application for variation of permission?

SUP 6.3.28

See Notes

SUP 6.3.29

See Notes

SUP 6.3.30

See Notes

SUP 6.3.31

See Notes

The FSA's powers in respect of application for variation of Part IV permission

SUP 6.3.32

See Notes

SUP 6.3.33

See Notes

- 21/06/2001

SUP 6.3.34

See Notes

How long will an application take?

SUP 6.3.35

See Notes

SUP 6.3.36

See Notes

SUP 6.3.37

See Notes

SUP 6.3.38

See Notes

How will the FSA make the decision?

SUP 6.3.39

See Notes

SUP 6.3.40

See Notes

Commencing new regulated activities

SUP 6.3.41

See Notes

SUP 6.3.42

See Notes

SUP 6.3.43

See Notes

SUP 6.4

Applications for cancellation of permission

- 01/12/2004

SUP 6.4.1

See Notes

- 21/06/2001

SUP 6.4.2

See Notes

- 21/06/2001

- Future version of SUP 6.4.2 after 06/08/2010

SUP 6.4.3

See Notes

- 21/06/2001

- Future version of SUP 6.4.3 after 01/04/2013

SUP 6.4.4

See Notes

- 21/06/2001

- Future version of SUP 6.4.4 after 06/08/2009

The application for cancellation of permission

SUP 6.4.5

See Notes

- (1) If a firm wishes to cancel its Part IV permission, it must complete and submit to the FSA the form in SUP 6 Annex 6 (Cancellation of permission application form).

- (2) A firm's application for cancellation of Part IV permission must be:

- (a) given to a member of, or addressed for the attention of, the Cancellations Team at the FSA; and

- (b) delivered to the FSA by one of the methods in SUP 15.7.5 R (Form and method of notification).

- (3) [deleted]

- (4) Until the application has been determined, a firm which submits an application for cancellation of Part IV permission must inform the FSA of any significant change to the information given in the application immediately it becomes aware of the change.

SUP 6.4.6

See Notes

SUP 6.4.7

See Notes

Information to be supplied to the FSA as part of the application for cancellation of permission

SUP 6.4.8

See Notes

- 21/06/2001

- Future version of SUP 6.4.8 after 01/04/2013

SUP 6.4.9

See Notes

- 21/06/2001

- Future version of SUP 6.4.9 after 01/04/2013

SUP 6.4.10

See Notes

- 21/06/2001

SUP 6.4.11

See Notes

Confirmations and resolutions

SUP 6.4.12

See Notes

SUP 6.4.13

See Notes

SUP 6.4.14

See Notes

Reports from professionals

SUP 6.4.15

See Notes

SUP 6.4.16

See Notes

Types of reports. See SUP 6.4.15 G

| Category of firm | Type of report |

| a bank or building society | • an audited balance sheet which confirms that, in the auditor's opinion, the firm has no remaining deposit liabilities to customers; • a report from auditors or reporting accountants; |

| a securities and futures firm | • a report from auditors or reporting accountants |

| an insurer | • an audited closing balance sheet which demonstrates that the firm has no insurance liabilities to policyholders; • a report from the auditors or reporting accountants; and • in some cases, an actuarial opinion as to the likelihood of any remaining liabilities to policyholders. |

SUP 6.4.17

See Notes

Approved persons

SUP 6.4.18

See Notes

When will the FSA grant an application for cancellation of permission?

SUP 6.4.19

See Notes

SUP 6.4.20

See Notes

SUP 6.4.21

See Notes

SUP 6.4.22

See Notes

The FSA's enforcement and investigation powers against a former authorised person

SUP 6.4.23

See Notes

SUP 6.4.24

See Notes

SUP 6.4.25

See Notes

SUP 6.4.26

See Notes

How long will an application take?

SUP 6.4.27

See Notes

How will FSA make the decision?

SUP 6.4.28

See Notes

SUP 6.4.29

See Notes

SUP 6.5

Ending authorisation

- 01/12/2004

SUP 6.5.1

See Notes

- 21/06/2001

- Future version of SUP 6.5.1 after 01/04/2013

SUP 6.5.2

See Notes

- 21/06/2001

SUP 6 Annex 1

Applications for variation and cancellation of Part IV permission

- 01/12/2004

See Notes

- 21/06/2001

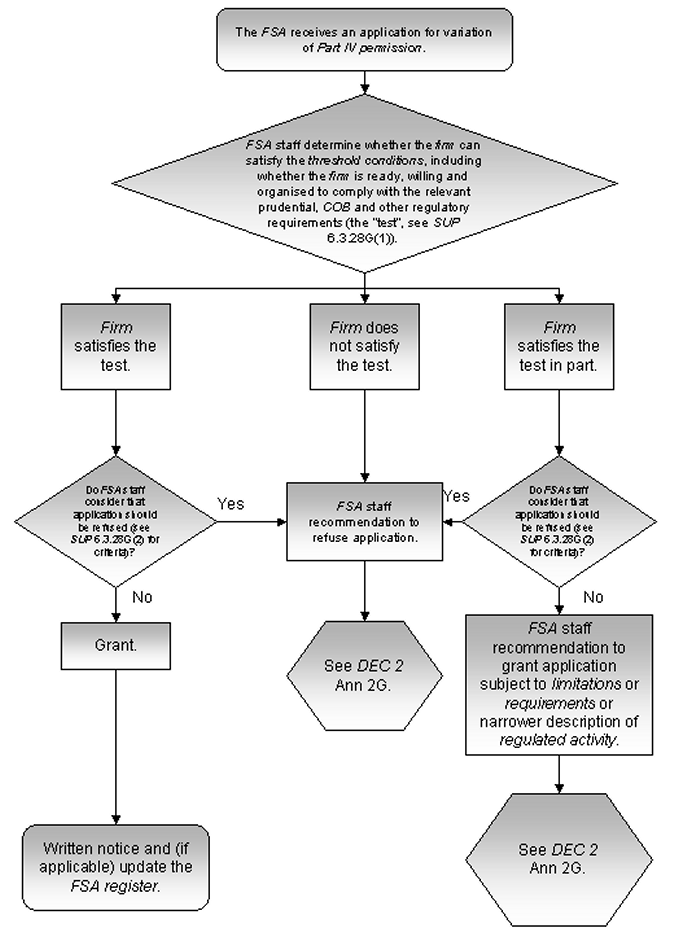

SUP 6 Annex 2

Summary of procedures on application for variation of Part IV permission

- 01/12/2004

See Notes

- 21/06/2001

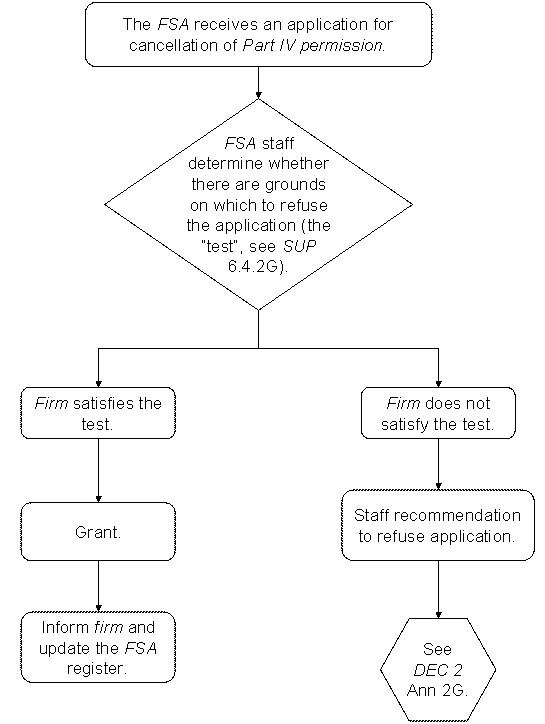

SUP 6 Annex 3

Summary of procedures on application for cancellation of Part IV permission

- 01/12/2004

SUP 6 Annex 3.

See Notes

- 21/06/2001

SUP 6 Annex 4

Additional guidance for a firm winding down (running off) its business

- 01/12/2004

SUP 6 Annex 4.1

See Notes

| 1. | If a firm has Part IV permission which enables it to hold client money or to carry on regulated activities including: | |

| (a) | carrying out contracts of insurance and effecting contracts of insurance; or | |

| (b) | accepting deposits; or | |

| (c) | safeguarding and administration of assets; | |

| it may require a long period (usually in excess of six months) in which to wind down (run off) its business. In these circumstances, it will usually be appropriate for the firm to apply for a variation of Part IV permission before commencing the wind down. | ||

| 2. | A firm that believes that it may need to apply for a variation of Part IV permission as a first step towards cancellation of its permission should discuss its plans with its usual supervisory contact at the FSA. | |

| 3. | If appropriate, in the interests of consumer protection, the FSA will require details of the firm's plans and will discuss them with the firm and monitor the winding down or transfer of the firm's business. During the period in which it is winding down, a firm will also be required to notify the FSA of any material changes to the information provided such as, for example, receipt of new complaints and changes to plans. | |

| 4. | If, after its Part IV permission has been varied, a firm has wound down its business, complied with any requirements imposed by the FSA and ceased to carry on regulated activities (or expects to do so within the next six months), it should then make an application for cancellation of its Part IV permission (see SUP 6.4 (Applications for cancellation of permission)). | |

| Use of own-initiative powers | ||

| 5. | If, for example, the FSA has consumer protection concerns, it may, however, use its own-initiative power under section 45 of the Act (Variation etc. on the Authority's own initiative) (see SUP 7 (Individual requirements) and ENF 3 (Variation of Part IV permission on the FSA's own initiative), to vary the Part IV permission of a firm which is winding down or transferring its regulated activities. | |

| Reporting requirements: general | ||

| 6. | If a firm is winding down (running-off) its business, the routine reporting requirements in SUP 16 (Reporting requirements) will apply unless the firm is granted a waiver. In addition, a firm may be asked to submit additional reports, for example, to enable the FSA to monitor the wind down. | |

SUP 6 Annex 4.2

See Notes

| 1. | If a firm makes an application to vary its Part IV permission to effect the winding down of regulated activities which it is carrying on including the repayment of client money, or the return of client deposits, custody assets or any other property belonging to clients, the FSA will expect it to have formal plans to ensure that: |

| (1) | the regulated activities are wound down in an orderly manner; |

| (2) | the regulated activities are properly completed and all client deposits, client money, custody assets or any other property belonging to clients are repaid, returned or transferred to another Authorised person; and |

| (3) | the interests of customers are not adversely affected. |

| 2. | A firm must comply with CASS 4.3.99 R and CASS 5.5.80 R (Client money: discharge of fiduciary duty) and CASS 4.3.104 R(Client money: allocated but unclaimed client money) if it is ceasing to hold client money. A firm must also cease to hold or control custody assets in accordance with instructions received from clients (including instructions set out in an agreement entered into in accordance with CASS 2.3.2 R (Custody: client agreement). These rules apply to both repayment and transfer to a third party. |

SUP 6 Annex 4.3

See Notes

| 1. | A firm carrying on insurance business which, ultimately, intends to cease insurance business completely, will first need to apply for a variation of its Part IV permission while it is running off its business. The firm should apply for a variation of Part IV permission to remove the activity of effecting contracts of insurance from its permission, thus restricting its activities to carrying out insurance contracts to enable it to run off its remaining insurance liabilities (see SUP 6.2.9 G ). | |

| 2. | Examples of variations of Part IV permission which may be appropriate in the context of winding down insurance business include: | |

| (1) | removing one or more regulated activities (for example, when a firm which has Part IV permission to carry on insurance business enters into run-off, its Part IV permission will need to be varied to remove the activity of effecting contracts of insurance in relation to new contracts of insurance); a new contract of insurance excludes contracts effected under a term of a subsisting contract of insurance. Thus the firm'spermission will be restricted to carrying out contracts of insurance to enable it to run off its existing liabilities; or | |

| (2) | imposing a limitation on regulated activities in a firm's Part IV permission or imposing a requirement on the type of investments a firm holds to support its insurance liabilities. | |

| 3. | An insurer ceasing to effect contracts of insurance is required to submit a scheme of operations in accordance with SUP App 2 (Insurers: scheme of operations). The FSA may require other information depending on the circumstances, for example an actuarial assessment of the firm's run-off. | |

| 4. | A firm that is ceasing effecting newcontracts of insurance in all categories of specified investment should refer to SUP App 2 for details of the specific reporting requirements that apply. | |

| 5. | An insurer should note that the FSA will not cancel a firm's permission until all the firm's insurance liabilities have been discharged, including any potential insurance liabilities. A firm is, therefore, advised to submit an application for cancellation of its Part IV permission when its run-off is completed. | |

SUP 6 Annex 4.4

See Notes

| 1. | A firm making an application to vary or cancel its Part IV permission which requires any approval from the Society of Lloyd's should apply to the Society for this in addition to applying to the FSA for the variation or cancellation. | |

| 2. | Where a firm has Part IV permission to manage the underwriting capacity of a Lloyd's syndicate as a managing agent at Lloyd's then, if it wishes to vary its Part IV permission to remove this regulated activity or to cancel its Part IV permission completely, special procedures will apply. | |

| 3. | (1) | As a first step, the firm should apply to the FSA for a variation of its Part IV permission to limit the regulated activity, after the Lloyd's syndicates have been closed, to permit no new business. Once the syndicates have been closed, the firm's consent from the Society to manage syndicates will also lapse |

| (2) | After a period of one year from the date of closure of the Lloyd's syndicates the firm may apply to the FSA to vary its Part IV permission, to remove the regulated activity or to cancel its Part IV permission entirely, as appropriate. At this time, a firm's approval from the Society of Lloyd's as a managing agent will cease. | |

| 4. | Firms which wish to discuss these procedures in more detail should contact their usual supervisory contactat the FSA and the Society of Lloyd's, as appropriate. | |

SUP 6 Annex 4.5

See Notes

| 1. As stated in SUP 6.2.9 G, where a bank, or other firm with permission that includes accepting deposits, wishes to cancel its Part IV permission, it will generally need to apply for a variation of that permission while it winds down its business. |

| 2. When a firm is winding down its business activities, it may be appropriate to vary its Part IV permission by imposing: (1) a limitation that no new deposits will be accepted; or (2) a limitation on the purchasing of investments for its own account; or (3) requirements concerning solvency. |

| 3. After a bank has discussed with the FSA the type of variation of Part IV permission the bank requires to wind down its business, it should make an application for variation of Part IV permission as directed in SUP 6.3.15 D and follow the guidance and procedures in SUP 6 as well as the additional procedures set out in this annex. |

| 4. The FSA may vary the firm's Part IV permission to impose one or more of: (1) a requirement that the firm takes certain steps or refrains from adopting or pursuing a particular course of action or to restrict the scope of its business in a particular way; (2) a limitation on accepting deposits, for example a limitation that no new deposits will be accepted; (3) a requirement restricting the granting of credit or the making of investments; (4) a requirement prohibiting the firm from soliciting deposits either generally or from persons who are not already depositors. |

| 5. The information concerning the circumstances of the application for variation of Part IV permission and the confirmations a firm is required to give to the

FSA

will differ according to the nature of the bank and its

Part IV permission. If appropriate, it may include, but will not necessarily be limited to: (1) a plan containing the arrangements made in respect of the business of any current depositors, for example how and when the firm intends to repay or novate arrangements with depositors; or (2) confirmation that the bank will not take any new deposits, will not roll over or renew any existing deposits at maturity and will repay all remaining deposits (including accrued interest) as they fall due for repayment |

|

Dealing with residual deposits: general

6. Where a firm has residual deposits which, for whatever reason, cannot be repaid, they may be protected by a number of different methods. The precise applicability of the courses to be followed depends upon the particular circumstances of the individual firm. The FSA's supervisory approach will be determined by the course of action taken. |

|

Holding funds on trust

7. In some circumstances, it may be appropriate for the firm to make an irrevocable transfer of funds, at least equal to the total of its deposits, to an independent trustee to be held on trust for the benefit of the depositors. Any such proposal should be discussed in advance with the FSA. The amount of funds held on trust should at all times exceed the total of all deposits, in order to provide for contingencies. Trust account arrangements are appropriate only in respect of solvent institutions. The guidance in paragraph 13 of this section applies in most cases. |

| 8. (1) A plan containing the arrangements should be made by the firm in respect of the business of any current depositors, for example how and when the firm intends to repay or novate arrangements with depositors. (2) The trustee should be an independent and appropriately qualified third party, nominated by the institution and acceptable to the FSA. (a) The trustee should usually be a major UK bank. If appropriate, an additional trustee from within the institution may be appointed, preferably in an advisory role. An internal trustee may help to ensure continuity if the firm and the trust are likely to remain in existence for the foreseeable future. (b) The FSA should be consulted about, or pre-notified of, a potential change of trustee. (c) Trustees are responsible for fulfilling their obligations under the trust deed. In practice, the FSA may wish to point out that certain factors need to be given consideration by the trustees and the institution (for example, the procedures for paying out to depositors). |

| 9. The FSA would require to see an opinion by the firm's legal advisers, confirming the validity and enforceability of the trust and in particular specifying the extent (if any) to which the trust arrangements may be set aside in future. The FSA reserves the right to request sight of the proposed trust documentation itself. |

| 10. The trustee has the right (and probably the obligation) to invest the funds, and in doing so should normally seek to "match" the maturity profile of the firm's deposit base. However, the following could result in deposit liabilities exceeding trust funds at any time: (a) maturity mismatches, that is, whether there are insufficient liquid funds across the maturity bands to repay depositors; or (b) changes in interest rates; or (c) the trustee's fees and disbursements. |

| 11. The trustee should not deposit, or otherwise invest, trust funds except in segregated accounts with third-party authorised institutions. |

| (1) An auditor's report, similar to that used to determine whether all the deposits have been repaid by a firm, should be provided to confirm that all depositors have been repaid before the discharge of a trust is allowed. (2) Auditors' reports, from the trust's auditors, should subsequently be obtained at intervals to demonstrate that funds in the trust continue to be at least equal to the remaining liabilities to depositors and that repayments have been properly made. The firm retains the ultimate responsibility to provide information to the FSA. (3) The FSA may, however, require the inclusion of a clause in the trust deed requiring the trustee to provide such information as may be requested. |

| 12. Entering into a trust arrangement does not "transfer" deposits or discharge the firm's contractual obligations to its depositors. |

|

Holding the funds in segregated accounts

13. The firm may place and retain an amount at all times at least equal to its deposit liabilities in a segregated account with its usual bankers. The advantage of this course of action is that if all deposit liabilities are matched by funds in such an account, then the firm is not carrying on the regulated activity of accepting deposits in contravention of the Act. |

| 14. Placing funds in a segregated account does not discharge a firm's contractual obligations to its depositors. |

SUP 6 Annex 5

Variation of permission application form

- 01/12/2004

See Notes

Supervision forms - FSA/form_links.jsp#supAnc

SUP 6 Annex 6

Cancellation of permission application form

- 01/12/2004

See Notes

Cancellation of permission application form - sup/cancellation_form.doc and sup/cancellation_mgi.pdf

SUP 7

Individual requirements

SUP 7.1

Application and purpose

- 01/12/2004

Application

SUP 7.1.1

See Notes

- 21/06/2001

SUP 7.1.2

See Notes

- 21/06/2001

Purpose

SUP 7.1.3

See Notes

- 21/06/2001

SUP 7.1.4

See Notes

- 21/06/2001

SUP 7.1.5

See Notes

- 21/06/2001

- Future version of SUP 7.1.5 after 06/08/2010

SUP 7.2

The FSA's powers to set individual requirements on its own initiative

- 01/12/2004

SUP 7.2.1

See Notes

- 21/06/2001

- Future version of SUP 7.2.1 after 06/10/2007

SUP 7.2.2

See Notes

- 21/06/2001

- Future version of SUP 7.2.2 after 06/08/2010

SUP 7.2.3

See Notes

- 21/06/2001

- Future version of SUP 7.2.3 after 06/02/2008

SUP 7.2.4

See Notes

- 21/06/2001

- Future version of SUP 7.2.4 after 06/02/2008

SUP 7.2.5

See Notes

- 21/06/2001

- Future version of SUP 7.2.5 after 06/02/2008

SUP 7.2.6

See Notes

- 21/06/2001

- Future version of SUP 7.2.6 after 06/02/2008

SUP 7.3

Criteria for varying a firm's permission

- 01/12/2004

SUP 7.3.1

See Notes

- 21/06/2001

SUP 7.3.2

See Notes

The FSA may seek to vary a firm's Part IV permission on its own initiative in certain situations including the following:

- (1) If the FSA determines that a firm's management, business or internal controls give rise to material risks that are not fully addressed by its rules, the FSA may seek to vary the firm's Part IV permission and impose an additional requirement or limitation on the firm.

- (2) If a firm becomes or is to become involved with new products or selling practices which present risks not adequately addressed by existing requirements, the FSA may seek to vary the firm's Part IV permission in respect of those risks.

- (3) If there has been a change in a firm's structure, controllers, activities or strategy which generate material uncertainty or create unusual or exceptional risks, then the FSA may seek to vary the firm's Part IV permission. (See also SUP 11.7.14 G to SUP 11.7.18 G for a description of the FSA's ability to vary a firm's Part IV permission on a change in control under section 46 of the Act.)

- (4) If a firm is a member of a financial conglomerate and the FSA is implementing supplementary supervision under the Financial Groups Directive with respect to that financial conglomerate by imposing obligations on the firm. Further material on this can be found in PRU 8.4 (Cross sector groups) and SUP 16.7.82 R to SUP 16.7.83 R (reporting requirements with respect to financial conglomerates).

SUP 7.3.3

See Notes

- 21/06/2001

SUP 7.3.4

See Notes

- 21/06/2001