2

Phase 2

Phase 2 Part A: Strategy-specific information requests

A1 Bail-in

2.1

The information outlined below will be requested from firms to facilitate the development of a resolution plan based on the use of the bail-in tool and to monitor firms’ compliance with MREL and their ability to meet requirements in the future.

- 01/01/2019

2.2

The information will be used to identify the barriers to using a bail-in resolution strategy; where further work is required to overcome barriers; and to develop a detailed plan to effect the transaction.

- 01/01/2019

2.3

The information will also provide a baseline for potential further work relating to the continuity of the firm’s critical economic functions during a bail-in.

- 01/01/2019

2.4

The information requested may include the following:

A1.1 Loss absorbing capacity: equity and liability structures

A1.2 Intra-group exposures

A1.3 Contract documentation

A1.4 Operational shared services

- 01/01/2019

A1.1 Loss-absorbing capacity: equity and liability structures

2.5

This information will permit resolution authorities to:

- Assess a firm’s quantum of loss-absorbing capacity (LAC), including location of debt by legal entity in the group, and the feasibility of imposing losses on certain liabilities through the transaction structure.

- Analyse intra-group debt arrangements to define the quantum and mechanics of down-streaming LAC to subsidiaries from a holding company and up-streaming losses to the holding company. This includes analysing funded or unfunded commitments (eg guarantees) that could potentially be called on to recapitalise the entities during resolution.

- Identify and assess LAC across UK entities for non UK headquartered groups where a bail-in would be led by overseas resolution authorities. This includes assessing the quantum and mechanics of down-streaming LAC to UK entities and up-streaming losses to an overseas parent.

- 01/01/2019

(a) Overview of potential bail-in liabilities across all legal entities

2.6

Firms may be required to provide information on all unsecured intra-group and external loans or debt securities in issue. This includes subordinated and senior debt and privately placed issuances.

- 01/01/2019

(a)(1) MREL Reporting

2.6A

As part of the information on loss-absorbing capacity (section A1.1), firms should also provide information on MREL resources, projected resources, and individual instrument characteristics as set out in section A4.

- 01/01/2019

(a)(2) Further information on bail-in liabilities

2.7

The following information may be required for each instrument:

- Date of issuance

- Type of debt (eg medium-term notes, loans, bonds, convertible bonds)

- Class of debt (eg senior unsecured, AT1, subordinated debt)

- The amount in issue (par value)

- The maturity (first call date for debt with call options, final legal maturity)

- The currency in which the debt is issued

- Legal entity or entities in the group which issued the debt (including special purpose vehicle or branch of an entity)[3]

- The governing law (English, other EU, US, other) for the contractual terms of the debt. Where applicable, highlight contractual provisions recognising UK resolution powers where the debt is issued under foreign law.

- Details of any guarantee applicable to the debt

- Details of the trustee, whether in Global Bearer form, Global Registered form or otherwise:

- If in Global Bearer form, who is the Depositary/Common Safekeeper and where is the note located?

- If in Global Registered form, who is the registrar and where is the register kept?

- Are there any notes not in global form?

- Details of the location of any other bearer debt instruments

- Details of the applicable clearing systems (Clearstream, Euroclear, DTC?) if tradeable

- The exchanges on which the debt is listed

- The firm’s accounting treatment of the debt (eg amortised cost or designated at fair value)

- Whether the debt bears a fixed, floating or zero-rate coupon

- If the debt is structured, the determinants of the coupon and/or the redemption value and other terms of the program, eg any call or put options

- For convertible debt, details of the conversion terms

- An indication of any non-standard terms included in the debt, eg unusual termination events

- ISIN/CUSIP number

Footnotes

- 3. Where the debt is issued by, or an obligation of, a branch, the branch, and not the bank, should be indicated as the issuer. Also, where the issuer of the debt is a branch, please indicate whether the liability for the debt obligations issued are shown on the books of the branch as liabilities of the branch.

- 01/01/2019

2.8

Firms may also be required to submit:

- Details of any constraints on the issuance of new shares (for example a specified maximum authorised share capital in the legal entity’s constitution).

- Details of the key terms of each class of equity instrument in issue, including governing law, whether or not controlling rights are attached, details of any preferential rights to dividends.

- The legal entity’s constitutional documents.

- A reconciliation between the firm’s regulatory returns and financial accounts.

- 01/01/2019

(b) Contractual terms of debt instruments

2.9

Firms may be required to provide the following details about the contractual terms of their debt instruments:

- The firm’s proposed approach to aligning the contractual terms of debt instruments to facilitate a bail-in (standardised contractual terms and non-standardised)

- Details of the firm’s debt instrument documentation, including:

- The number of active and inactive contracts[4]

- The number of standardised and non-standardised contracts

- A breakdown according to type of debt issued

- The governing law of each contract

- Details of the system used for safekeeping legal documents and an estimate of how quickly information can be extracted from this system.

- Details of the non-standardised clauses in debt instrument agreements, including how these differ from the clauses used in standardised agreements.

- Identify events of default that could be triggered in resolution and the materiality of such provisions across the contract population (eg cross-default provisions, termination upon restructuring)

Footnotes

- 4. Inactive means no actual current service/transaction under contract.

- 01/01/2019

(c) Intra-group LAC arrangements

2.10

Firms may be required to provide the following information relating to intra-group LAC:

- An overview of the firm’s intra-group capital and funding structure

- The amount of intra-group LAC held by each legal entity in the group

- Notification if triggers for writing down intra-group financial exposures rest with host authorities

- Detailed arrangements for capital support and/or contingent liabilities between group entities

- The key terms and conditions of intra-group term funding, including:

- identity of issuer

- tenor

- whether subordinated or senior ranking

- whether convertible debt (if so give details of triggers)

- governing law

- any pledge or collateral, and

- any other relevant terms

- Details of cross-guarantees or cross-default provisions between group entities

- Details of contractual provisions recognising UK resolution powers where the debt is issued under foreign law.

- 01/01/2019

(d) Management Information (MI) systems

2.11

Firms may be required to provide the following information relating to their MI systems:

- Details of how information on LAC and funding is produced and updated using the firm’s existing MI systems

- An estimate of how quickly the firm would be able to produce (or update) the information outlined in this supervisory statement – and actions that could be taken to improve this

- Evidence of data quality - for example details of how MI is verified and signed off

- 01/01/2019

Sample template

2.12

Deleted.

- 01/01/2019

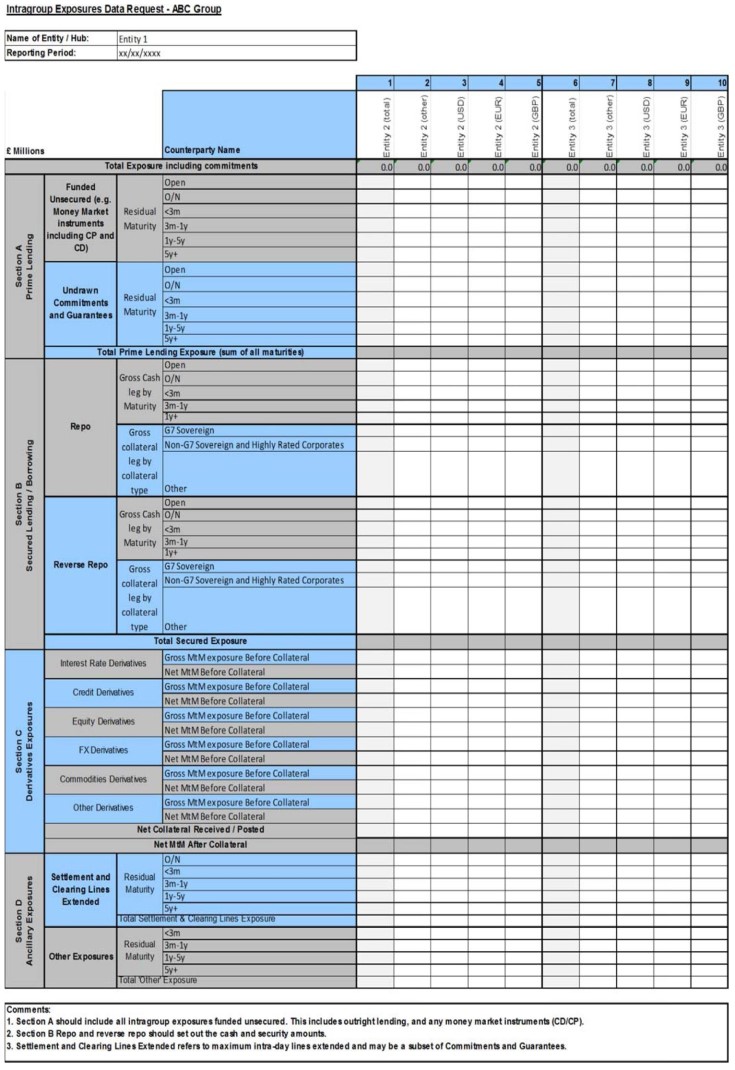

A1.2 Intra-group exposures

2.13

Groups will be required to quantify business as usual (twelve-month average) intra-group exposures between legal entities (branch or subsidiary). This will allow the authorities to assess the feasibility of executing a bail-in. It will also support post-resolution business reorganisation.

- 01/01/2019

2.14

The analysis should cover the entities of the group that are material from a funding flow perspective.

- 01/01/2019

2.15

For groups where the preferred group resolution is bail-in at the level of UK parent company, the assessment should identify intra-group flows between the UK entity and all significant legal entities within the group.

- 01/01/2019

2.16

For non-UK groups, where the preferred group resolution strategy is a bail-in led by overseas resolution authorities, the assessment will seek to identify intra-group flows that involve UK entities.

- 01/01/2019

2.17

Firms should submit information across products such as money market funding, debt instruments, secured transactions, collateral alignment, derivatives, off balance sheet commitments and guarantees. Exposures should be differentiated by remaining tenor and material currencies. Firms should also provide information on historic peak exposures over the previous twelve months.

- 01/01/2019

Sample template

2.18

The tables below are templates for summary information on intra-group exposures. However, supervisors will guide firms on the form of information to be provided as part of bilateral work (the templates are not regulatory returns). Firms should ensure management information systems are capable of producing the information requested by supervisors.

- 01/01/2019

- 01/01/2019

Intragroup Exposures Data Request - ABC Group

Peak Exposures in past 12 months

£ Millions

| Entity | Entity 1 | Entity 2 | Entity 3 | |||||

| 1 | 2 | 7 | 8 | 13 | 14 | |||

| Counterparty |

Entity 2 | Entity 3 | Entity 1 | Entity 3 | Entity 2 | Entity 1 | ||

| Section A Prime Lending |

Prime Lending - Funded Unsecured | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | |

| Undrawn Commitments and Guarantees | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | ||

| Section B Secure Lending / Borrowing |

Repo | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | |

| Reverse Repo | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | ||

| Section C Derivatives Exposures |

Net MtM Before Collateral | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | |

| Net Collateral Received / Posted | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | ||

| Net MtM After Collateral | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | ||

| Comments | |

| 1. | Peak exposures should be on 'Total Currency' basis. |

| 2. | Monthly peak should be calculated separately for each of the categories. It is likely that all the peaks across the rows may not occur on same date. |

| 3. | Scope of items included in each category should follow the previous tabs. |

- 01/01/2019

A1.3 Contract documentation- resolution trigger events

2.19

In order to ensure that key services can be maintained in resolution, and that contracts prevent termination in resolution, firms are expected to provide contract documentation for service agreements and market counterparties. This information will allow the authorities to:

- assess the risks of adverse reactions from service providers (service agreements) and market counterparties (trading documentation) in resolution (eg triggering contract accelerations, cross-defaults, etc.);

- identify the measures required to alleviate these risks, including changes required to documentation (standardised[5] and non-standardised) to better align with the preferred resolution strategy;

- assess the extent to which the firm has amended contractual documentation (including terms of debt instruments) to facilitate cross-border recognition of resolution actions; and

- assess the extent to which resolution powers can be used to override termination provisions.

Footnotes

- 5. Standardised documentation refers to ISDA agreements. Non-standardised documentation refers to bilateral or bespoke agreements.

- 01/01/2019

2.20

Firms should describe their system for safekeeping legal documents and explain how easy it is to extract information from this system. Firms are expected to set out the firm’s proposed approach to aligning trading documentation (standardised and non-standardised) to facilitate the preferred resolution strategy.

- 01/01/2019

(a) Service Agreements

2.21

Quantify the scale of the firm’s service agreement documentation, providing a breakdown by:

- Number of contracts- active and inactive

- Breakdown of standardised versus non-standardised

- Economic materiality

- Group legal entities that are party to the agreements

- Governing law (English, other EU, US, other)

- 01/01/2019

2.22

For economically material contracts firms should provide details of key clauses such as break/insolvency, services, costs, encumbrances. Firms should make clear where these relate to intra-group agreements and agreements with external parties.

- 01/01/2019

(b) Market Counterparties (including FMI)

2.23

Quantify the scale of the firm’s trading documentation, including general breakdown by:

- Number of contracts- active and inactive

- Breakdown of standardised versus non-standardised

- Economic materiality

- Group legal entities that are party to the agreements

- Governing law

- Type of counterparty (eg sell-side dealer counterparties, FMI)

- 01/01/2019

2.24

For economically material contracts:

- Where there are non-standardised clauses, provide a description of the clauses that differ from the standardised agreement, and how they differ.

- Where there are triggers for collateral calls (eg debt ratings) from market counterparties, identify and describe them.

- Where there are events of default that could be triggered in resolution, identify and describe the materiality of such provisions across the contract population (eg cross-default provisions, termination upon restructuring, etc.)

- 01/01/2019

(c) Guarantees (issued and received, internal and with external parties)

2.25

Quantify the scale of the firm’s guarantees, including general breakdown by:

- Number of guarantees- active and inactive

- Breakdown of standardised versus non-standardised

- Breakdown between intra-group and extra-group guarantees

- Economic materiality

- Group legal entities that have issued/received the guarantees

- Governing law

- 01/01/2019

2.26

For economically material contracts:

- Where there are non-standardised clauses, provide a description of the clauses that differ from the standardised agreement, and how they differ.

- Identify events of default that could be triggered in resolution and the materiality of such provisions across the contract population (eg cross-default provisions, termination upon restructuring)

- 01/01/2019

(d) Contract Documentation

2.27

Set out the firm’s proposed approach for aligning contract documentation (standardised and non-standardised) to facilitate the preferred resolution strategy.

- 01/01/2019

A1.4 Operational shared services- bail in

2.28

The information provided in this section will allow the authorities to understand any critical internal or external operational shared services that may hinder resolution and affect post-resolution business reorganisation.

- 01/01/2019

2.29

An indicative list of the information that firms should submit is listed below. Where critical dependencies may represent a barrier to the execution of a post bail-in business reorganisation, firms should set out how they will overcome this. The information should:

- (a) Identify solutions to provide continuity of service throughout resolution (eg resolution-proof service agreements, service company models, outsourcing).

- (b) Identify dependencies of the UK group operations on i) other group entities, and ii) third-party entities for the following services:

- Human resources support (eg payroll).

- IT (eg data storage and processing, data centres, software licences, access to external providers, application maintenance and user support).

- Transaction processing (eg legal transactional issues such as anti-money laundering).

- Real estate provision or management (eg facilities management, security, real estate portfolio management).

- Legal service/compliance (eg corporate legal support, compliance support).

- (c) Describe governance and management arrangements (eg reporting lines) for the services above.

- (d) Describe material cross-border activity (eg where services are provided by UK entities to non-UK entities (branch or subsidiary) and vice versa).

- (e) Provide an assessment of the extent to which critical interdependencies can be maintained in a bail-in.

- 01/01/2019

A2 Partial transfer and bridge bank

2.30

The information outlined below will enable the authorities to develop a resolution plan based on the use of stabilisation transfer tools under the Banking Act 2009 – that is a whole or partial transfer to a bridge bank or private sector purchaser.

- 01/01/2019

2.31

Information provided by firms will enable the authorities to assess the feasibility of grouping and separating the firm’s functions into viable business units. It will facilitate the identification of barriers to splitting up a firm, and actions that would overcome these, and ensure that the firm’s critical economic functions are maintained.

- 01/01/2019

A2.1 Effecting a transfer

2.32

The information provided in this section will facilitate the identification of the different options for grouping the firm’s assets and liabilities to be saleable or transferable to a third party or bridge bank. Firms are expected to provide the following:

(a) Strategy and business model analysis

- Identify asset portfolios that may be transferred to a bridge bank or private sector purchaser and asset portfolios that may be wound down in the Bank Administration Procedure.

- Provide details of the profit drivers of the business, and an assessment of the sustainability of profitability following transfer.

- Provide an assessment of the quality of assets and liabilities.

- Identify critical functions (and critical shared services) that will be included within the asset portfolios designated for a transfer.

- Provide an assessment of feasibility and credibility of each of the transfer options

(b) Details of existing asset valuation, controls and systems for fair value assets and amortised cost assets[6]

(c) Identification of barriers to achieving separable resolution units, covering:

- Outstanding repos and warranties on loan assets

- Securitisations Syndicated loan transactions

- Asset servicing arrangements

- Material outstanding litigation

Footnotes

- 6. The overriding purpose is for the Authorities to gain a better understanding of the firm’s existing valuation processes and systems. Please refer to Phase 2 C4 Valuation as a guide to the information that might be requested.

- 01/01/2019

A2.2 Operational shared services- partial transfer/bridge bank

2.33

Information provided in this section will enable the authorities to understand any critical internal or external operational shared services that may hinder resolution and post-resolution bridge bank exit and/or business reorganisation. An indicative, but non-exhaustive, list is shown below. Where critical dependencies may represent a barrier to feasible transfer, the firm should identify solutions. Firms are expected to provide the following:

- (a) Business solutions to provide continuity of service throughout resolution (eg resolution-proof service agreements, service company models, outsourcing).

- (b) Dependencies of the UK group operations on i) other group entities, and ii) third-party entities for the following services:

- Human resources and HR support (eg payroll).

- IT (eg data storage and processing, data centres, software licences, access to external providers, cyber-risk defences, application maintenance and user support).

- Transaction processing (eg legal transactional issues such as anti-money laundering).

- Real estate provision or management (eg facilities management, security, real estate portfolio management).

- Legal service/compliance (eg corporate legal support, compliance support).

- (c) Governance and management arrangements of UK operations.

- (d) Description of material cross-border activity (eg where services are provided by UK entities to non-UK entities (branch or subsidiary) and vice versa).

- (e) Analysis on the extent to which critical interdependencies can be maintained in a partial transfer/bridge bank.

- 01/01/2019

A2.3 Continuity

2.34

Firms are expected to assess the level of continuity of critical functions provided when executing a transfer of each of the packages of assets and liabilities (described in Section A2.1) to a private sector purchaser or bridge bank and taking into account the key dependencies identified in Section A2.2. Firms may be requested to consider a range of options for packaging the assets and liabilities. Firms should:

- (a) Explain how the packages would be separated from the group, and provide an expected timeline for achieving this.

- (b) Outline how any barriers to continuity, which would prevent a critical function or business line from continuing to operate during separation, could be overcome.

- 01/01/2019

2.35

Examples of barriers that the firm should address include activities that span legal jurisdictions, associated derivatives exposures and netting arrangements, or operational/financial/structural idiosyncrasies.

- 01/01/2019

A2.4 MREL reporting

2.35A

Firms should also provide information on MREL resources, projected resources, and individual instrument characteristics as set out in section A4.

- 01/01/2019

A3 Bank Insolvency Procedure

2.36

Most of the information required to assess the feasibility of executing a Bank Insolvency Procedure is already provided to the authorities through business as usual regulatory reporting and the information provided in Phase 1. This includes the requirement to be able to provide the FSCS with a Single Customer View (SCV) file within 72 hours.

- 01/01/2019

2.37

The PRA requires firms to be able to produce a single, consistent view of each eligible depositor’s funds, to enable the FSCS to implement rapid payout in the event of a resolution. We require firms at all times to be able to provide information to us to assess its SCV capabilities, in line with the PRA’s Compensation rules.

- 01/01/2019

2.38

However firms may be required to submit additional information, for example, if they undertake a specific economic function that may present particular complications in resolution. In this case firms may be required to submit more granular information as outlined in Part B of Phase 2 (eg cash services).

- 01/01/2019

A4 MREL reporting

2.38A

The PRA expects firms that have been notified by the Bank of England that they are, or are likely to be, subject to external or internal MREL in excess of regulatory capital requirements to provide information on MREL resources, projected resources, and individual instrument characteristics.

- 01/01/2019

2.38B

The PRA expects firms to submit information on MREL resources as set out in the templates in the appendix of this statement. The names and contents of the templates are as follows:

- MREL Resources (MRL001) - amount and maturity profile of MREL eligible liabilities, cross-holdings of MREL and regulatory capital that does not qualify as MREL resources.

- MREL Resources Forecast (MRL002) - projected MREL eligible resources.

- MREL Debt (MRL003) - individual characteristics of internal and external MREL resources, issued by entities within the UK consolidation group.

- 01/01/2019

2.38C

The PRA expects firms to report at the following frequencies.

- MREL Resources (MRL001) - the same frequency, reporting end date and submission due date as firms’ COREP C 01.00 submissions.

- MREL Resources Forecast (MRL002) - the same frequency, reporting end date and submission due date as firms’ Capital+ submissions. Firms that submit Capital+ on a monthly basis may submit this template on a quarterly basis (with the same submission due date as Capital+ submissions and the same reporting dates as would be the case if their Capital+ submissions were quarterly) at all levels of application of reporting. The PRA may ask these firms to submit the information in this template on a more frequent basis.

- MREL Debt (MRL003) -quarterly, on the same reporting end date and submission due date as firms’ COREP C 01.00 submissions. The PRA may ask firms to submit MRL003 template on a more frequent basis.

- 01/01/2019

2.38D

The following table shows the level of application and frequency of MREL reporting:

| MREL Resources (MRL001) | MREL Resources Forecast (MRL002) | MREL Debt (MRL003) | |

| Level of application | UK consolidation group, UK resolution group,[7] material subsidiaries and material subgroups | UK consolidation group, UK resolution group, material subsidiaries and material subgroups | One template should be submitted in respect of all entities within the UK consolidation group |

| Frequency | Aligned with COREP C 01.00 | Aligned with Capital+ | Quarterly (aligned with COREP C 01.00) |

Footnotes

- 7. For example, a multiple point of entry (MPE) group headed by a resolution entity for which the Bank is the home resolution authority.

- 01/01/2019

2.38E

Firms should provide information in the XBRL format using the templates in the appendix.

- 01/01/2019

2.38F

The PRA expects firms to commence reporting at the following times.

- 01/01/2019

External MREL

- Firms that have been notified by the Bank of England prior to 1 January 2017 that they are likely to be set external MREL in excess of regulatory capital requirements (whether interim and/or end-state) should start reporting, at the same time and frequency as their Capital+ and COREP C 01.00 reporting from 1 January 2019.[8]

- Firms that have been notified after 1 January 2017 that they are likely to be set external MREL in excess of regulatory capital requirements (whether interim and/or end-state) by the Bank of England, should start reporting at the same time and frequency as their Capital+ and COREP C 01.00 reporting, starting at least 12 months prior to the end of the transitional period set by the Bank of England. The Bank of England intends to communicate to firms the first expected reporting date at the same time as it communicates external MREL to firms.

Footnotes

- 8. Similarly to firms’ Capital and COREP C 01.00 reporting, the first submission for most firms will be based on figures as at 31 December 2018.

- 01/01/2019

Internal MREL

- Firms that have been notified by the Bank of England prior to 1 January 2020 that they are likely to be set internal MREL in excess of regulatory capital requirements (whether interim and/or end-state) should start reporting, at the same time and frequency as their Capital+ and COREP C 01.00 reporting, starting 6 months after the Bank of England has communicated their internal MREL, but not before 1 January 2019.[9]

- Firms that have been notified after 1 January 2020 that they are likely to be set internal MREL in excess of regulatory capital requirements (whether interim and/or end-state) by the Bank of England, should start reporting at the same time and frequency as their Capital+ and COREP C 01.00 reporting, starting at least 12 months prior to the end of the transitional period set by the Bank of England. The Bank of England will communicate to firms the first expected reporting date at the same time as it communicates internal MREL to firms.

Footnotes

- 9. Reference as in footnote 2.

- 01/01/2019

Phase 2 Part B: Critical function information requests

2.39

The following section sets out additional information and analysis that may be requested from firms in order to further assess the feasibility of a particular resolution strategy, identify barriers to this, and make a detailed resolution plan which ensures that any critical economic functions are protected.

- 01/01/2019

2.40

Firms should consider the need to maintain continuity in the critical economic functions that they provide as well as the need to limit contagion and disruption to customers counterparties and other market participants.

- 01/01/2019

2.41

The authorities’ need for further information will depend on the complexity of the individual firm and its preferred resolution strategy. Additional information requested may include, but is not limited to, the following areas, which are outlined in more detail in the following tables:

- 01/01/2019

B1 Payments, clearing and settlement

2.42

This section focuses on the Financial Market Infrastructure (FMI) which are critical to the firm and customers with which it has a correspondent banking relationship.

- 01/01/2019

| Provide, as appropriate, the following data and analysis for the significant legal entities that have been identified in Phase 1. |

||

| 1 | Business overview | List of FMIs used for each core business area within each jurisdiction, with key metrics (value/volume of transactions, £mn). Under which jurisdictions are the FMIs located? Access to FMIs? Direct membership: Names of legal entities which have direct access. What are the necessary comforts (eg pre-funding) that will need to be delivered to the FMI to maintain direct participation in the FMI at the point of resolution? Indirect membership: For legal entities that access FMI indirectly, please provide a high-level description of how access is obtained (either via other legal entities in the Group or via third parties). Are there any existing contingency plans on alternative means to access FMI indirectly or apply for direct access? How practical is it to set up (pre-resolution) contingency arrangements with alternative providers? Even where no contingency plan is in place, please provide an assessment on the following: Name the likely third parties that can be utilised Where intra-group relationships are changed to third-party relationships, what are the high-level steps required to ensure ex-affiliates can be treated on third-party commercial terms (eg system changes and recalibration of risk/exposure limits)? What are the operational steps required? What is the timescale? What are the likely financial terms? |

| 2 | FMIs | FMIs: Are there any FMIs in which the Group is a material provider/receiver of liquidity to facilitate settlement? Are there any securities clearing schemes for which the Group provides a settlement service? (eg liquidity provider in CREST) Are there any CCPs in which the group is a material (Top 5) participant? How many alternative financial institutions exist in the market for these services? How many alternative financial institutions are able to take on additional settlement capacity, based on current market share? |

| 3 | Provision of services to other entities | Other legal entities within the Group: Please provide a high-level assessment of how payments, settlement and clearing systems are critical to other critical functions within the Group. Agency and Correspondent Banking Relationships: Where other internal/external entities rely on the Group for agency and correspondent banking, provide a breakdown of customer types eg banks, corporates, institutional investors, government entities. Name the legal entities which provide the service. What are the terms of the contracts governing the relationships and how would these relationships be affected in a resolution? Could payments, clearing and settlement services be maintained pending a sale of the firm to a third party or bridge bank? Under what scenarios would the firm cease to offer settlement bank services to another financial institution customer? Please include commentary on case where the Group is significant direct participant in FMI in non-UK jurisdictions. Can these relationships still be maintained given the loss of the global franchise? If so, would these services be continued under current terms? Describe the credit approval and operational processes in providing settlement services eg reliance from customers in terms of credit to support their daily settlement requirements. Describe the channels that customers use in communicating with the firm ie the scale of customers reliant and dependent upon firm proprietary systems in accessing FMIs versus market-wide channels such as SWIFT. Cash Management business (where applicable): Brief description of main products offered, and clients serviced. In particular, please identify any globalised services such as cross-currency products and CLS clearing. Key metrics for current business where appropriate (revenue, number of clients etc). How many alternative providers exist in the market for these services? How easily could clients’ funds be transferred to an alternative provider? How would proprietary vs client custodial assets be separated? What rights does the Group have over client assets? Indicate which products/services would be core to the regional business post-resolution. |

| 4 | Procurement of services from other entities |

Settlement/clearing Banking Relationships: Where the firm relies on other entities for settlement/clearing bank services, provide the following, for each of the FMI utilised: A walkthrough of the payment life-cycle, from initiation of payment instruction to settlement and booking in customer account ledger. Provide critical cut-off times and highlight points of irrevocability. Provide an assessment of the average daily volume of in-flight transactions for each payment scheme (£mn). Provide average and peak volumes (£mn) of ATM withdrawals. An overview of any service agreements including whether the service agreements can survive a resolution and assure continued indirect access. Where no service agreements are in force, can indirect access continues, and for how long? |

| 5 | Funding | What are the BAU and stressed liquidity needs by currency for payment, clearing and settlement activities? What are the main sources of intraday/overnight liquidity in BAU? Are there any contingent funding sources? |

| 6 | Operational and managerial interdependencies |

For each of the following: Funding- any dependence on a centralised Treasury function Compliance and risk functions eg KYC/AML, fraud management Key operational centres Data centres and IT infrastructure (propriety systems, hardware and software, including outsourcing and licences) Key staff Please provide: Legal entities where the functions are located (for intra-group dependencies). Please indicate the level of capital in each entity, and to what extent it is capitalised intra-group. Details of key clauses such as break/insolvency, services, costs, encumbrances, etc (please break down between intra-group and extra-group agreements) High-level assessment of whether the service agreements can survive a resolution and whether current structure is capable of implementing the preferred resolution strategy |

| 7 | Business Model review (forward-looking – restructuring of Group) |

Please identify the jurisdictions/regions where continued direct access to global payment/clearing facilities is critical to the business model (in terms of revenue/profit and funding) and franchise. For the remaining regions consider which local payment and clearing functions would still need to be retained. |

- 01/01/2019

B2 Trading book analysis

2.43

This section focuses on the trading book, with particular focus on the firm’s booking model, trade documentation and operational continuity of the trading book in a resolution.

- 01/01/2019

| Number | Heading | Required data/Detail required |

| Provide, as appropriate, the following data and analysis for the significant legal entities that the firm has identified. | ||

| 1 | Risk Management practices (booking models) overview |

Please provide a diagram of the firm’s booking model Please provide information on the jurisdiction where each legal entity involved is located, as well as the use of unregulated affiliates. Information below is to be provided for each combination of UK-regulated legal entity and its unregulated affiliate (UK or overseas) within a group, where they transact with each other: |

| 2 | Derivatives booking model | For each legal entity and branch in the United Kingdom, please provide: OTC derivatives external gross Mark to Market (MtM) and notional held (£mn) OTC derivatives intra-group gross MtM and notional held, by entity pairs and by desks (£mn) Monthly average and peak derivative external trade volume by value, by desks (£mn) Monthly average and peak derivative intra-group trade volume by value, by desks (£mn) OTC derivatives external gross MtM and notional executed by non-UK traders held, by country (use ISO country code) and by product line (£mn) House Initial Margin (IM) and notional with CCP and Derivative Exchanges executed by non-UK traders by country and exchanges (£mn) |

| 3 | Cash securities booking model | For each legal entity and branch in the United Kingdom, please provide: Monthly average and peak external trade volumes (number) and values (£mn) by asset class (eg rates, credit, equities) or lines of business, entities and depositories Monthly average and peak intra-group trade volumes (number) and values (£mn) by asset classes (eg rates, credit, equities) or line of business, entity pairs and depositories |

| 4 | Derivatives FMI membership |

Direct derivatives clearing memberships: House Initial Margin (IM) and notional with CCP and Derivative Exchanges (£mn) External Clients IM and notional with CCP and Derivative Exchanges (£mn) Intra-group IM and notional with CCP and Derivative Exchanges (£mn) Indirect derivatives clearing memberships: IM and notional with CCP and Derivative Exchanges held with third-party clearers (£mn) |

| 5 | Operational and managerial interdependencies |

For each of the following: Middle and back offices, including key staff Data centres and IT infrastructure (proprietary systems, servers, hardware and software, including outsourcing and licences) Please provide: Legal entities where the functions are located (for intra-group dependencies). Please indicate the level of capital in each entity, and to what extent it is capitalised intra-group. Copy of service agreements, or as a minimum details of key clauses such as break/insolvency, services, costs, governing law, encumbrances, etc (please break down between intra-group and extra-group agreements) High-level assessment of whether the service agreements can survive a resolution and whether current structure is capable of implementing the preferred resolution strategy. |

- 01/01/2019

B3 Cash services

2.44

This section focuses on the scope and scale of the cash services business line, and operational continuity of these operations in a resolution.

- 01/01/2019

| Number | Heading | Required data/Detail required |

| Provide, as appropriate, the following data and analysis for the significant legal entities that the firm has identified and geography (E&W, Scotland, NI) | ||

| 1 | Customers | Overview of services provided, including volumes |

| 2 | Joint ventures | Copies of relevant contracts, or as a minimum detail of key clauses such as break/insolvency, services, costs, governing law, encumbrances. |

| 3 | Property | For each Cash Centre: Ownership details Operational details (if outsourced) Copies of relevant contracts if not self-owned or operated, or as a minimum details of key clauses such as break/insolvency, services, costs, governing law, encumbrances. |

| 4 | IT systems | Name and overview of system function/use and whether off shelf or bespoke Ownership details- licence requirements if not owned/developed in-house Details of other relevant licences and intellectual property |

| 5 | Key service providers |

Details of key clauses such as services provided, break/insolvency, costs, for: ATM replenishment Cash in Transit (CIT) movements IT systems essential for cash business Equipment maintenance (High Speed Note Sorting (HSNS), ATMs etc) Printing of own-note issuance Processing of own-note issuance |

| 6 | Funding/Capital Requirements/Costs |

Provision of treasury function for cash handling Guarantees Booking of business, and transfers of ownership of notes |

| 7 | Wind down/separation |

Management assessment of barriers to resolution |

- 01/01/2019

B4 Custody services

2.45

This section focuses on the scope and scale of custody services (including ancillary services such as securities lending), as well as funding and operational continuity in resolution.

- 01/01/2019

| Number | Heading | Required data/Detail required |

| Provide, as appropriate, the following data and analysis for the significant legal entities that the firm has identified | ||

| 1 | Business overview | Describe key services (eg custody, fund accounting, securities lending etc) provided. Please provide revenue and P&L breakdowns for each service. Overview of the custody market, including the Group’s market share and how many alternative providers exist in the market for these services. How do systems and business structure facilitate transfer of clients? Overview of firm’s sub-custodian network. What are the key payments and settlement FMIs used in the custody business? Are they accessed directly or indirectly? |

| 2 | Customers | Other legal entities within Group: What are the interactions and interdependencies between custody and other business lines and legal entities? Please provide a high-level assessment of how custody is critical to other critical functions within the Group. What are the contingency plans for alternative custody services? What are the timescale and costs? External customers: Please provide an overview of the client base (eg pension funds, sovereign wealth funds). Provide a breakdown of customer types eg banks, corporates, institutional investors, government entities. |

| 3 | Funding |

BAU and stressed/peak liquidity needs by currency for custody activities (£mn) Main sources of intraday/overnight liquidity in BAU Are there any contingent funding sources? |

| 4 | Operational and managerial interdependencies | For each of the following: Funding- any dependence on a centralised Treasury function Sub-custodian and depositary network Custody-related products (eg transition management, cash management, reinvestment of collateral in securities lending etc) Regulatory and risk functions eg KYC/AML compliance Key operational centres Data centres and IT infrastructure (proprietary systems, servers, hardware and software, including outsourcing and licences) Key staff Please provide: Legal entities where the functions are located (for intra-group dependencies). Please indicate the level of capital in each entity, and to what extent it is capitalised intra-group. Copy of Service agreements, or as a minimum details of key clauses such as break/insolvency, services, costs, encumbrances, governing law etc (please break down between intra-group and extra-group agreements) High-level assessment of whether the Service agreements can survive a resolution and whether current structure is capable of implementing the preferred resolution strategy |

- 01/01/2019

Phase 2 Part C: Additional information requests

2.46

To facilitate resolution planning the authorities may require additional information on the following:

- 01/01/2019

C1 Business reorganisation plan

2.47

Following intervention using the bail-in resolution tool (introduced by the Banking Reform Bill) the Bank of England may require a bail-in administrator or one or more directors of the bank under resolution to prepare a business reorganisation plan. This plan would assess the factors that led to the bank’s failure and set out how the business will be returned to viability and operate as a going concern. The RRD is also likely to require business reorganisation plans to be developed following application of resolution tools (the business reorganisation would be complementary to any business reorganisation required under the EU State Aid Framework). A business reorganisation plan should have regard to separability and ease of unwind for core functions and business lines, including on a cross-border basis.

- 01/01/2019

2.48

The reorganisation plan will need to consider a range of options. These may include: (i) options for maintaining the continuity of core functions; (ii) ease of unwind of core functions, and (iii) ease of sale or transfer of core functions. The consideration of individual options should be based on reasonable commercial assumptions.

- 01/01/2019

2.49

To facilitate the timely production of a reorganisation plan in the event of resolution, the PRA may require a firm to consider in advance a range of restructuring options that might present an effective route to restoring the long-term viability of the firm post-resolution. Supervisors will guide firms on how to progress this should it be required.

- 01/01/2019

C2 Operational continuity

2.50

This section focuses on operational continuity in a resolution.

- 01/01/2019

(a) Table on high-level costs split by legal entities and business lines.

The purpose of this table is to map the high-level operational costs incurred by firms by legal entity and business line.

Where a firm’s parent organisation is a UK-incorporated entity, firms should complete this table for all significant legal entities in the group, both domestically and internationally (subsidiaries and branches). This will allow the UK authorities to better co-ordinate post-resolution restructuring, by improving understanding of the operational costs of each legal entity and line of business.

Where a firm’s parent organisation is incorporated outside the United Kingdom, firms should only complete this table for:

o UK subsidiaries (and any associated overseas branches); and

o UK branches of any overseas subsidiaries.

- 01/01/2019

| Organisational Structure | |||||||||||||

| Legal Entity 1 | Legal Entity 2 | Legal Entity N | LOB 1 | LOB 2 | LOB N | ||||||||

| Fixed | Marginal | Fixed | Marginal | Fixed | Marginal | Fixed | Marginal | Fixed | Marginal | Fixed | Marginal | ||

|

Cost Component |

FO Staff | ||||||||||||

| BO Staff | |||||||||||||

| IT Operations and Support | |||||||||||||

| IT Infrastructure | |||||||||||||

| Group / HO Functions | |||||||||||||

| Premises: Branch/FO | |||||||||||||

| Premises: HO/BO | |||||||||||||

| TOTAL | |||||||||||||

LOB: line of business.

FO: front office.

BO: back office.

HO: head office.

- 01/01/2019

(b) Operational continuity- service company models

2.51

This section focuses on the operational continuity in a resolution for firms that have significant service company models.

- 01/01/2019

| Number | Heading | Required data/Detail required |

| Provide, as appropriate, the following data and analysis for the significant legal entities that the firm has identified | ||

| 1 | Structure, Scope and Scale |

Provide a high-level summary (including diagrams where appropriate) of how the service companies sit within the corporate structure of the Group. To what extent does management of the service companies overlap with the Group? Provide a summary of the services which are provided by the service companies to the different parts of the Group (include diagrams where appropriate). Provide a summary of the transfer pricing arrangements and terms of trade between the service companies and the Group. Are there any other extra-Group entities that depend (directly or indirectly) on the service companies for critical shared services? Provide some metrics for size ie number of employees and total assets, and compare these with the Group’s metrics. Provide a balance sheet, P&L and cash-flow statement. What authorities regulate the service companies? What assurances exist for continuous provision of critical shared services between home and host authorities? For non-UK firms, do the service companies have a subsidiary or branch physically located in the United Kingdom? |

| 2 | Capital and Funding |

What is the capital structure of the service companies? Is this capital structure bankruptcy remote? Is the Service companies’ capital committed (can it be transferred to other entities within the Group)? What are the BAU and stressed liquidity needs? What level of liquidity buffer do the service companies have? Are there any contingent funding sources? Provide an estimate (given current Group operations) of how long the service companies can operate in a resolution. |

| 3 | Documentation |

Are service agreement contracts at arms’ length? Do contracts exclude resolution (or subsequent change of control) as a termination event? Do contracts provide for the service recipients (or any successors) to continue receiving services for an appropriate transition period? Copy of the contracts- or as a minimum details of key clauses such as break/insolvency, services, governing law, timing and details of settlement etc. |

- 01/01/2019

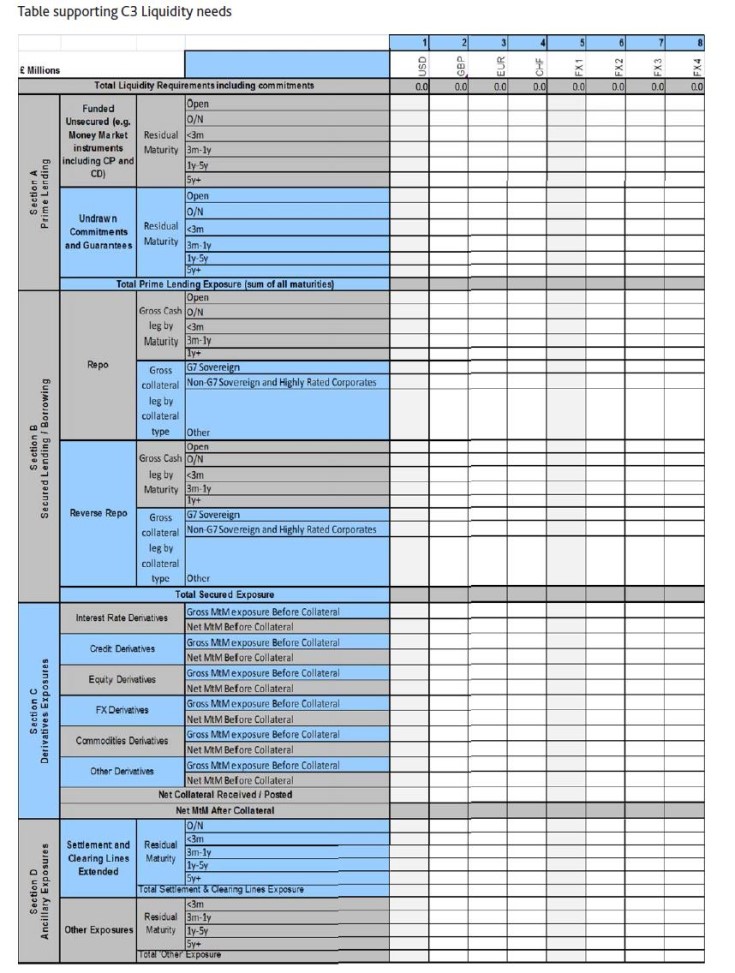

C3 Liquidity needs

2.52

In order to plan for resolution and possible restructuring the authorities will need to understand firms’ business as usual funding requirements in more detail than their current liquidity reporting permits. Firms should expect to work with supervisors to establish the information that they will be required to submit. They should expect this to include information that clarifies their funding requirements by and across legal entities and by currency. They will also need to provide information on intraday liquidity, including intraday liquidity peaks.

- 01/01/2019

2.53

The template on page 38 provides an example of the information that firms may be required to provide, and the format in which they could expect to provide it. Information requests will be in line with international policy on liquidity needs in resolution (eg the FSB).

- 01/01/2019

- 01/01/2019

C4 Valuation in resolution

2.54

A fundamental part of resolution planning and executing resolution powers is for the authorities to conduct a robust valuation of a firm. This valuation is designed to identify equity value, quantum of losses or an insolvency counterfactual valuation. To support resolution planning as part of normal supervision, firms will need to be able to demonstrate appropriate systems, controls and resources for the following:

- fair value valuation of fair valued assets, including the prudent valuation regime;

- fair value and cash-flow based valuations of assets valued at amortised cost; and

- any other asset valuation eg good will, deferred tax assets, other provisions etc.

- 01/01/2019

2.55

The assessment of a firm’s valuation systems and controls, processes and resources will form part of business-as-usual supervision to ensure firms are resolvable in the event of failure. This section sets out the authorities’ information requirement to assess whether a firm’s valuation systems and controls are adequate to support a credible valuation in the event of resolution.

- 01/01/2019

(a) Table on high-level costs split by legal entities and business lines:

The PRA’s existing prudent valuation regime will provide a starting point from which to test the appropriateness of a firm’s fair value valuations in the event of resolution. However, systems and controls, process and resources around the prudent valuation of a trading business will need to be robust and adaptable to both a medium term and accelerated unwind scenario, which would reflect the full cost of exit rather than just risk neutralisation. Therefore, the authorities may need to gather additional information not typically found in the fair and prudent valuation regimes to reflect the greater difficulty and judgement involved in a resolution (eg accelerated unwind valuation).

Valuation submissions to the PRA will typically be quarterly, six weeks in arrears. As part of this process, firms may be requested to resubmit information if it is proportionate and timely to do so (eg during periods of stress), where a reasonable period of time has elapsed or a material change has occurred in the business since the last submission. Therefore, firms must have the ability to provide updated prudent valuation estimates in short order.

- 01/01/2019

(b) Additional requirements for resolution beyond prudent valuation (assets currently valued on an amortised cost basis):

The PRA’s existing valuation regime does not request information for the regular valuation of these assets. However, as part of resolution planning, firms will also need to have the capability to provide information to inform prudent, conservative, fair and realistic valuations of these assets. This will include fair value and cash-flow valuations. A fair value valuation is dependent on the exit strategy.

A cash-flow valuation would inform the restructuring strategy. Firms’ valuation systems and controls, processes and resources will need to have the ability to provide fair value and cash-flow valuations of these assets in short order. This will need to include a description of policy and procedures for obtaining fair value and cash-flow valuations of these assets.

- 01/01/2019